Asset Management Manual

A guide for practitioners!

Asset Management Manual

A guide for practitioners!

The final report of the PROCROSS project (ENR 2012) includes a specific cross-asset allocation procedure, which is based in the combined approach described above and comprises the following activities:

A procedure for cross-asset allocation is also provided in the Report 806 of the US National Cooperative Highway Research Program (Maggiore, Ford, CH 2M Hill, High Street Consulting Group & Burns & McDonell, 2015). In this case, the procedure is made up of the tasks below:

Form the above listings, it can be concluded that both procedures are quite similar, even though the PROCROSS method do not include a step for comparing the effects of funding levels.

A further procedure for cross-asset allocation is presented next. Although, on the one hand, this procedure is based on the two methods outlined previously, on the other hand it assumes that the organization has developed a performance framework (see section 1.4) so the following items are already available:

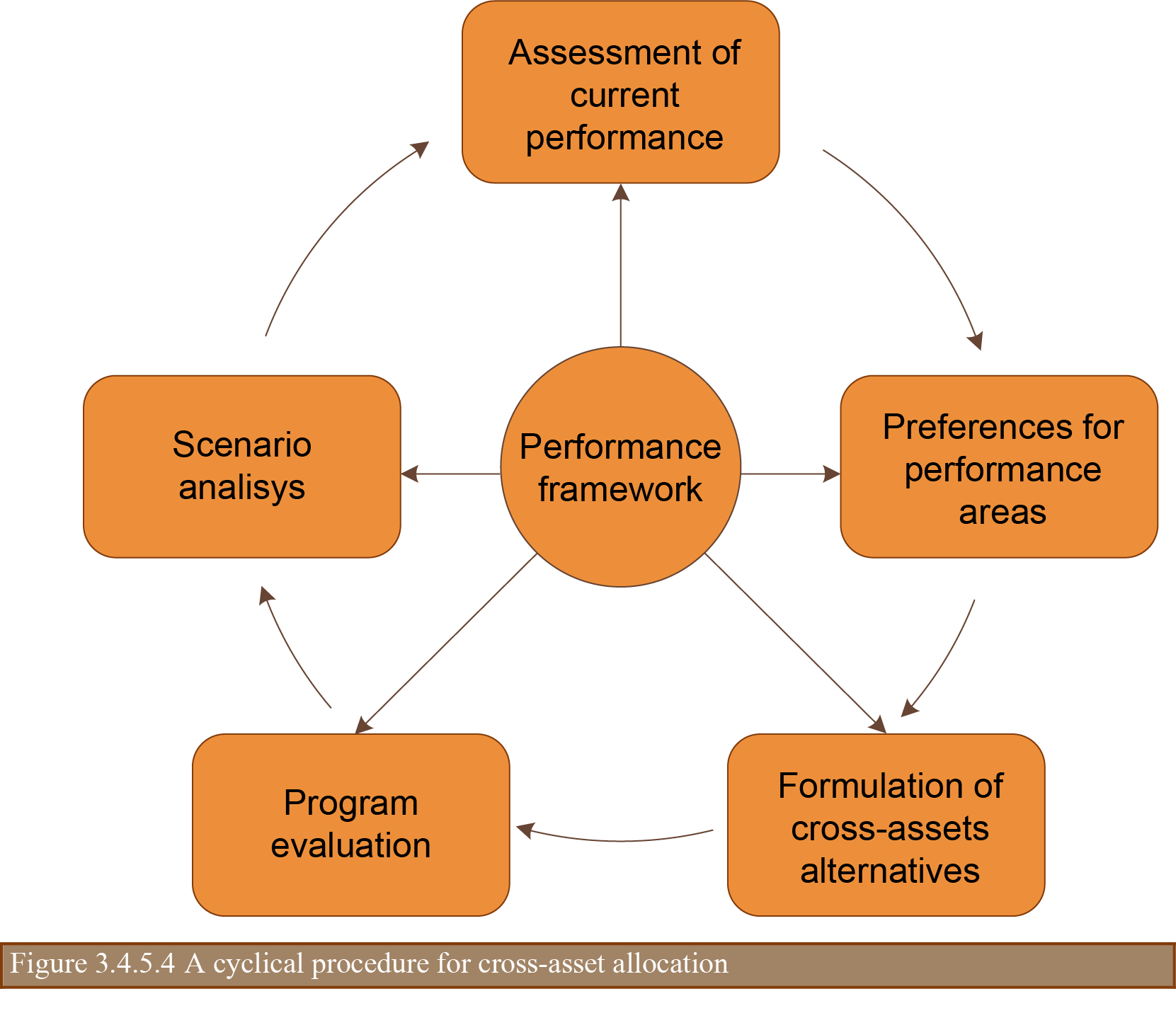

Given the above, a cyclical procedure for cross-asset allocation can be depicted as shown in Figure 3.4.5.4.

The steps illustrated in this figure can be described as follows:

Assessment of current performance. It implies determining the organization progress in reaching the strategic targets defined within the performance framework. Any difference will represent a performance gap that has to be addressed through the proposed investment programs.

Development of individual programs. Works dealing with improving the condition of individual assets or any other attribute of the road network are identified in this step using specialized management systems for each asset / operational issue (pavements, bridges, safety, etc.) The resulting programs are intended to minimize the risk of not achieving the targets proposed for each performance area.

Formulation of cross-asset alternatives. Combines the projects selected for the individual programs in order to cover all performance areas with a single works program. Also, define alternative programs containing project options different from those selected in the previous step so that the preferences stated in the performance framework can be considered while carrying out cross-asset allocation under budget constraints.

Program evaluation. Refers to a decision-making process that should be applied to identify, using diverse criteria, the alternative of a cross-asset program that best contributes to attaining the targets specified in the performance framework. This involves comparing projects in terms of their benefits, which are normally expressed in different units depending on the performance area addressed by each project. Thus, all benefits should be normalized (i.e. converted to a common metric) to allow for comparison.

The international experience on cross-asset works programming comprise the application of decision-making techniques such as the following (Proctor & Zimmerman, 2016; Porras-Alvarado, Han, & Zhang, 2014):

The multi-criteria analysis may provide various advantages. First, the analyst priorities are specifically declared through the assignment of weights to the different performance areas. At the same time, the decision maker objectives are clarified while translating them into criteria for evaluating intervention alternatives. Furthermore, the system for evaluating alternatives is transparent since it leaves a clear record of the weights and criteria applied. Finally, the multi-criteria analysis is flexible as it permits criteria to be added as well as disparate criteria to be used.

However, it also has disadvantages: i) Costs and risks are not explicitly involved in the analysis; ii) Results are very sensitive to the values attributed to weights, so these can be determinant of the alternatives selected.

Cross-asset optimization involves the use of recursive mathematical procedures to find the maximum level of benefits that can be produced by a given set of investments subject to technical performance requirements and budget constraints. Its application implies the use of a software capable of evaluating a considerable number of options (hundreds or even thousands) to find the one yielding the greatest benefits. It this way, cross-asset optimization generates more sophisticated and quantified results, yet it requires extensive data about all candidate projects evaluated.

Scenario analysis. This last step is equivalent to the last step of the cross-asset allocation procedure proposed in the US NHCRP Report 806 (Maggiore, Ford, CH 2M Hill, High Street Consulting Group, & Burns & McDonell, 2015). As the latter, it consists of determining the effects of various investment scenarios and funding levels in the performance of the road network both as a whole and considering each individual asset / operational feature individually. The results of such an analysis can be used to identify the needs of stakeholders concerning the different performance areas and the budgeting required to meet those requirements, and eventually to modify appropriately the performance targets in use.

Finally, it should be noted that the procedure described above is based on the combined approach for cross-asset allocation portrayed in figure 3.4.5.3.3, as it starts with the individual analysis of each of the different performance areas, and then it combines candidate projects from the different programs to obtain a solution oriented towards achieving the performance goals of the road organization.