This section describes the core issues which a Road Organization should take into consideration when developing its planning activities: Asset Management Plan, Financial Plan, Asset Valuation and Programming.

The section contains a chapter about the importance of having a strong Asset Management Plan, including the proposed steps to be taken into consideration when developing such an instrument. It contains a chapter with information about what a Financial Plan should be and why an Organization should develop one, explaining the process to build such an instrument. The section also contains information about Asset Valuation, explaining its concept, and why an Organization should do it. It also presents an approach to calculate asset value, it suggests the international accounting standards to be adopted when calculating the asset value. It proposes a list of asset classification. It also provides useful information regarding asset treatments, cost information, condition data, and valuation steps and key aspects of the steps. Finally the section contains a chapter about programming, which explains what is works programming, and why they should be prepared. It also presents the maturity levels for works programming, it also explains the process of developing works programs and allocating resources to individual projects.

An Asset Management Plan (AMP) can be conceptualized as a “business plan” for an organization that has stewardship responsibilities for an infrastructure network. It should reflect the vision of the road organization in relation to its mission.

The following chapter focus on the reasons why an organization should have a plan, explaining its benefits, the type of questions that should be considered; and the concerns that an AMP should demonstrate in its implementation. This chapter also contains considerations about the wide range target audience of an AMP. Finally it proposes a list of steps to be taken into consideration.

An asset management plan (AMP) can be conceptualized as a “business plan” for an organization (PIARC 2008) that has stewardship responsibilities for an infrastructure network. When considering whether or not to develop an AMP, it may be useful to consider questions such as the following (PIARC 2014, PIARC 2016.1):

The AMP is a document that brings all of these concerns together into a single plan (perhaps with multiple references to supporting documents and plans) and that tells the story of the Road Organization in relation to its mission. There is no one “” document structure for an AMP since the structure will depend on how the organization plans to utilize the document. However, there are real benefits to having a standard AMP structure, which enables a repeatable and standard document.

The audience for the AMP can be arranged into concentric rings of involvement. If an asset management leader and steering committee consisting of representatives from key sections within the organization are already in place, then many of those individuals will naturally serve on the core team that does most of the writing of the AMP. The remainder of the steering committee members would serve as reviewers. If the steering committee and leader are not yet appointed, then it will make sense to appoint AMP authors who can eventually serve in the implementation roles.

Practitioners describe the AMP as a “living” document. As the AM planning process is repeated on an agreed cycle, the output of that process (the AMP) will develop and change to accommodate the organization’s increased knowledge and understanding of service levels and performance measures and how the organization’s policies and programs affect them (PIARC 2014).

A best practice AMP should demonstrate the following:

The AMP plays a key role in connecting the organization’s corporate strategic direction with implementation tools, ensuring that the organization can achieve its mission in the most cost-effective manner while delivering the required levels of service.

The target audience for the AMP is potentially wide ranging, with different elements of the plan of interest to different stakeholders, as described below.

Senior decision makers: Senior decision makers, including elected members, need to support the AMP and make the necessary financial commitment to support the plan. The AMP can be a valuable tool in showing system condition, funding needs, and the impact of different funding levels (PIARC 2005, PIARC 2016.2).

Road Organization’s staff: Asset managers and/or practitioners are responsible for developing and then delivering the AMP. The plan can be used as a benchmark to monitor progress against the organization’s asset management framework. The AMP can be a valuable tool in showing system condition and identifying performance gaps but also in explaining priorities and the resource allocation decision making process. The AMP explains how the Road Organization does business.

Other stakeholders: These are potentially wide ranging and may include road users, local communities, and special interest groups. The plan informs the stakeholders about how the organization does business, including its basis for resource allocation in managing their network.

The AMP explains the basis for the allocation of budgets and the development of financial plans. It provides evidence to justify the levels of budgets that are necessary and the likely impact different funding scenarios may have on the performance of the asset (PIARC 2005, PIARC 2016.2). Through the AMP, asset management may be set in the wider business context and provide support for needs, etc. The plan also provides information on how asset management, including works programs, will be delivered and funding requirements met. Consideration should also be given to how the AMP links to or incorporates the highway maintenance plan as well as short- and long-term transportation planning.

The proposed steps involved in developing the AMP are summarized and explained below.

Step 1: Develop asset inventory

The asset inventory or registry is a database or spreadsheet inventory of all assets within an asset group or service for which the asset management plan is being developed. At minimum, it needs to include pavement and bridge assets. Inclusion of other physical assets is recommended.

Step 2: Assess performance and failure modes (PIARC 2013)

1. Undertaking asset condition evaluation serves two purposes:

To identify rehabilitation and maintenance needs, the condition evaluation must be timely (Usually annual or biannual) and detailed. Condition evaluation requires the identification of individual defects, such as transverse cracks in pavements, blocked drainage appurtenances, or roof leaks, and the evaluation of their severity and extent. Monitoring this detailed level of condition has several advantages, as follows:

2. Assessing the condition of assets subject to regulatory-driven inspections follow specific standards for assessing condition.

Asset performance has the following three primary components:

Operating cost, utilization, and the condition of the asset should be known to estimate the timing of each of the following possible failure modes:

3. Evaluating economic failure: An asset has reached a point of economic failure when it is no longer competitive with asset options that are available in the marketplace for delivering the same or improved function. A business case including a lifecycle cost analysis of feasible alternatives is usually required before a change-out of the asset goes ahead.

4. Evaluating capacity failure: The asset does not have the capacity to meet its designed performance.

Step 3: Determine residual life

Residual life is determined once the likelihood and timing of the imminent failure mode is known. Residual life is the time until failure and is particularly important for managing high-cost and high-risk (high-consequence) assets. A prediction of time to failure enables the asset manager to initiate a planning process for the renewal of the asset prior to incurring the costs and service-level impacts of failure.

Step 4: Determine lifecycle and replacement costs

Lifecycle costing (LCC) involves determining all costs of owning and operating the asset from planning through retirement or replacement.

The lifecycle cost of an asset is determined as follows:

LCC = capital cost + lifetime operating costs + lifetime maintenance costs + disposal cost − residual value

Lifecycle costs are largely locked in at the design stage, indicating that collaboration between operations, maintenance, and design staff is an essential requirement during the design of new facilities or the modification of existing facilities, as is the need for full lifecycle cost comparisons to be made for feasible alternatives.

Step 5: Determine future demand

This step provides an assessment of the potential impact of future demand on the transportation assets.

Possible factors to consider to assist in the forecast of new demands may include:

Steps required to determine future demand:

Typical reliability assessments of future traffic demand forecasting are:

Minimum: Based on the experience of staff predictions with consideration of the knowledge of past demand trends and likely growth patterns.

Low: Based on robust projection of a primary demand factor (e.g. : population growth) and extrapolation of historic trends. Assessment of risk associated with demand change broadly understood and documented.

Medium: Based on mathematical analysis of past trends and primary demand factors. A range of demand scenarios is developed (e.g. low, medium and high).

High: Based on mathematical analysis of past trends and primary demand factors. A range of demand scenarios is developed with the consideration of risk and the identification of mitigation options.

Step 6: Determine business risk (criticality)

This step identifies critical assets, which are those assets that are high cost and/or result in detrimental levels of service and significant consequences if they fail. By understanding where the greatest risks lie, it is possible to focus investment and attention where it matters most and actively mitigate against non-tolerable risks through the asset management planning process.

Risk exposure is calculated as follows:

Risk exposure = probability of failure × consequence of failure

Step 7: Optimize operations and maintenance investment

Optimization of operations and maintenance investment requires that strategies are actively considered for the purposes of meeting an asset’s service-level performance requirements. An informal survey by the committee as part of the development of this guide indicated that 6 percent of respondents undertook reactive maintenance only, and 46 percent stated that their maintenance was somewhat proactive but mostly reactive.

Step 8: Optimize capital investment

Steps 1 to 7 have provided the following information:

1. An asset register spreadsheet on which to build the asset management planning analysis;

2. Condition of each asset and likely failure mode;

3. Likely remaining life or timing of asset failure;

4. Current replacement cost of each asset;

5. Current and targeted levels of service;

6. Identification of critical assets using a risk exposure score calculation method;

7. Current and likely future operations and maintenance costs after reviewing maintenance and operations strategies to meet level of service targets.

Step 8 is to bring the data and information established in Steps 1 to 7 together to evaluate the best operation, maintenance, and capital investment strategies needed to deliver the required level of service at the best cost and level of risk exposure. This process is often referred to as optimization.

Step 9: Determine the best funding strategy

This step evaluates the available funding strategies to implement the asset management plan’s investment requirements determined in Steps 1 through 8.

Asset management staff provide the financial analysts with investment requirements represented in the funding “buckets” using the rules and policies established by the transportation agency for allocating costs to customers and other funding sources. An analysis of the impact of the charges for the proposed maintenance, operations, and capital expenditures required to meet the prescribed levels of service over the planning period should be included in the asset management plan. This information then represents the net increase (or decrease) in the cost of service associated with the plan.

Step 10: Document the asset management plan

Step 10 is the final step in the process and is concerned with the packaging of the asset management plan information into a form that communicates well with operators and executive decision makers.

Scotland, T. (2007). Road asset management plan for Scottish trunk roads: April 2007–March 2009, https://www.transport.gov.scot/media/32978/j408891.pdf.

AASHTO (2013). AASHTO Transportation Asset Management Guide - A Focus on Implementation - Executive Summary. Pubblication no. FHWA-HIF-13-047, https://www.fhwa.dot.gov/asset/pubs/hif13047.pdf.

PIARC 2005. Evaluation and funding of road maintenance in PIARC member countries, Technical Committee 9 Financing and Economic Evaluation, ISBN: 2-84060-182-6, (https://www.piarc.org/ressources/publications/2/4552,09-08-VCD.pdf).

PIARC 2008. Asset management practice, Technical Committee 4.1 Management of Road Infrastructure Assets, ISBN: 2-84060-211-3, (https://www.piarc.org/ressources/publications/4/6020,2008R11WEB.pdf).

PIARC 2013. Maintenance methods and strategies, D.2 Road Pavements, PIARC Paris France, ISBN: 978-2-84060-323-8, (https://www.piarc.org/ressources/publications/7/19456,2013R08-EN.pdf).

PIARC 2014. The importance of road maintenance, PIARC Paris France, ISBN: 978-2-84060-349-8, (https://www.piarc.org/ressources/publications/1/22262,2014R02EN.pdf).

PIARC 2016.1. Preserve your Country's roads to Drive Development, PIARC Paris France, ISBN : 978-2-84060-385-6, (https://www.piarc.org/ressources/publications/8/24531,2016R07EN-Gestion-Patrimoine-Routier-Road-Assets-Management-World-Road-Association-Mondiale-Route.pdf).

PIARC 2016.2. Assessment of budgetary needs and optimisation of maintenance strategies for multiple assets of road network, PIARC Paris France, Technical Committee 4.1 Management of Road Infrastructure Assets, ISBN: 978-2-84060-378-8, (https://www.piarc.org/ressources/publications/8/24533,2016R04EN.pdf).

Road Asset Management Plan 2016-2019, (http://www.highland.gov.uk/downloads/file/502/road_asset_management_plan).

Transport New Zealand, (http://www.nzta.govt.nz/resources/state-highway-asset-management-plan/docs/state-highway-asset-mgmt-plan-2012-2015.pdf).

Shetland Islands Council - Roads Asset Management Plan, (http://www.shetland.gov.uk/roads/documents/DraftRAMP.pdf).

FHWA (2019). Federal Highway Administration Transportation - Asset Management Plan, (https://www.fhwa.dot.gov/asset/plans.cfm).

These practices have been tested in several instances and case studies are being prepared. They will be presented here when available. If you want to share a case study, please contact assetmanagementmanual@piarc.org.

The financial plan is an assessment of funding needs over the next 3 to 5 years.

The following chapters explain more in detail:

All organizations need to plan their budgets at least annually, but those organizations practicing more advanced asset management are likely to have planned their budgets for the next three to five years if not longer. Undertaking road maintenance clearly requires a financial commitment from senior leaders in the organization. This financial commitment is needed to fund the staffing of the organization and routine and cyclical maintenance activities as well as periodic maintenance activities. Where organizations undertake road maintenance themselves, the financial plan should also include budgeting for physical resources to undertake the maintenance activities that include labour, materials, and construction equipment.

The budget allocated may come from different sources that fund both the maintenance activities (including routine maintenance) and the capital activities (investment). This funding may come directly from the central government, donor organizations, local governments and municipalities, or tolls. The financial plan will be used to demonstrate the activities that the budget will be allocated to and why the budget is needed.

The financial plan should be part of the asset management plan. It should be informed by lifecycle planning and the maintenance standards adopted by the organization.

The financial plan sets out the approach that the organization will use to allocate the budget that has been provided. Depending on the maturity of the asset management organization, the financial plan should be undertaken for the short (basic), medium (proficient), and long (advanced) term. This will give the organization a transparent view of its financial commitment. The financial plan should provide details of the funding required to be delivered. The breakdown of the financial plan should align with the work types and volumes. The plan should also include the impact of different levels of funding on the network, such as the impact on performance.

When governments or senior leaders in the organization have not committed to the budget, the financial plan must demonstrate the funding required to meet the performance set out in the asset management policy and strategy. The financial plan, however, will only be based on the planned work that will be undertaken when the organization has committed to the budget. This planned work may be adjusted depending on the budget allocated. It should be noted that lifecycle planning, described in Chapter 2.4,2 Lifecycle Planning, should be used to determine the most cost-effective means of achieving the financial plan.

When setting and agreeing on budgets with the senior leaders in the organization, it is important that asset managers make a strong and robust case to invest in asset maintenance. The financial plan should therefore demonstrate that the transportation infrastructure maintenance activity can only be efficient if it is planned in the long term and the asset management practices described in this guide are adopted.

A practical example of demonstrating the benefits of long-term funding include investment in preventative maintenance techniques, which may provide significant value for money when compared to more expensive treatments that are applied based on a “worst first” approach.

Ideally, the most effective financial plans cover between 5 and 15 years. This means that the allocation of resources, and especially of financial resources, has to be anticipated well in advance so organizations can plan accordingly.

The financial plan therefore supports organizations in identifying both the required and available financial resources in future years. As such, it is an essential document to support the exchanges between the senior leaders in the organization, road owners, financing authorities, and those responsible for asset management. Its main function is to do the following:

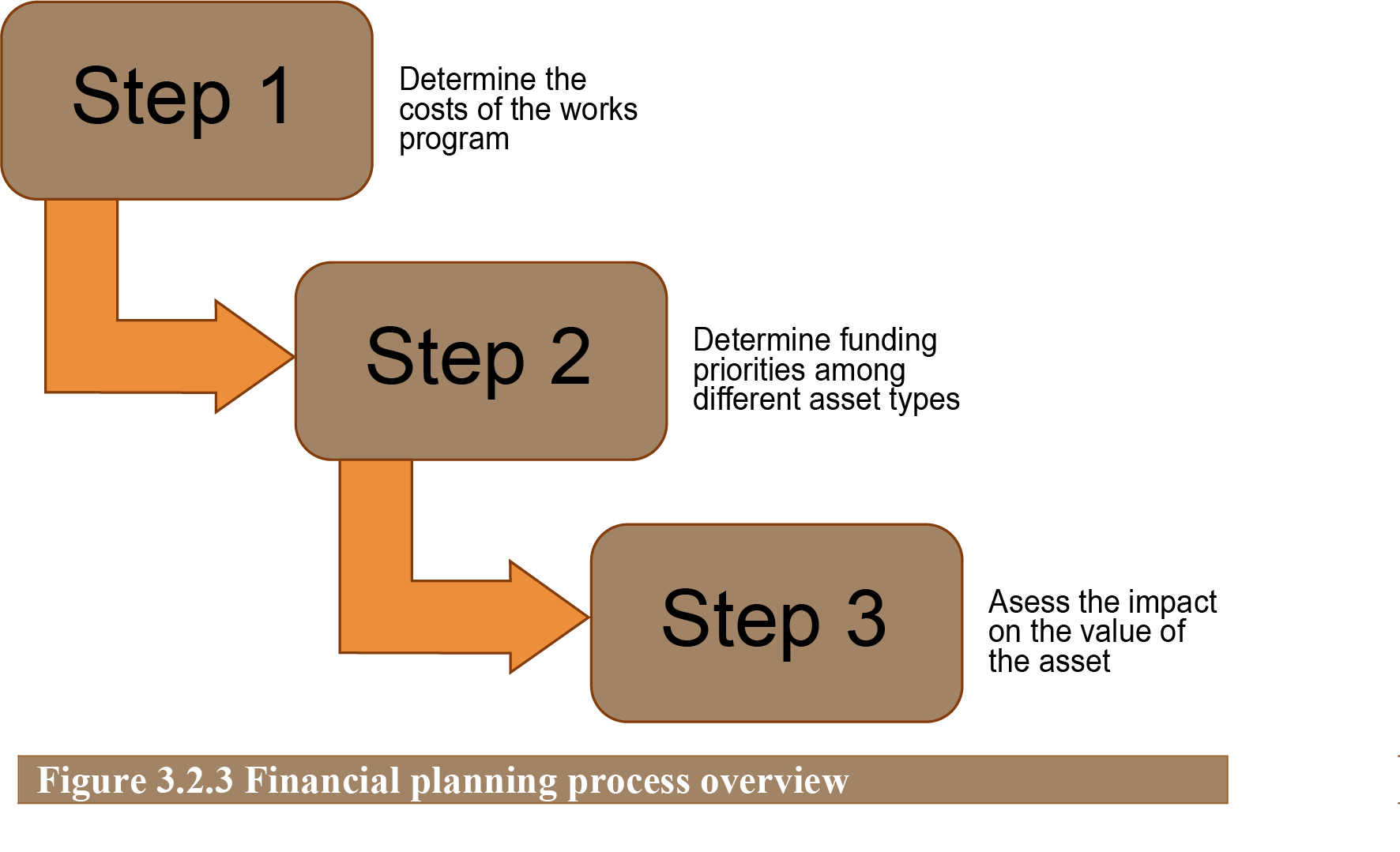

The process of building a financial plan is illustrated in Figure 3.2.3.

Step 1. Determining the cost of proposed works

The financial plan should build on the works plans (AMEC 2013) that contain the maintenance schemes the organization is required to undertake. Works plans are described in greater detail in section 3.4. The works plan should contain the schemes that have been prioritized according to the policy of the organization at least for the upcoming year but ideally for the next three to five years. It may also contain a number of different work plans to be implemented depending on the funding provided (Lepert 2012). Ideally, each asset group, such as pavements, structures, or lighting, should have determined costs of its own work plan.

Step 2. Allocating the funds among program areas

Depending on the funding available, there may be a requirement to allocate budgets to each asset type, such as pavements or structures, from a single capital allocation. Traditionally, many organizations have allocated budgets on a historical basis. For example, roads may get 60% of the maintenance budget and structures 20%. The financial plan, therefore, may be based on historical spending levels. More advanced organizations may consider prioritizing their assets to ensure that both those assets most in need of funding for the organization to meet its strategic priorities and those assets that may be critical towards the organization, such as strategic bridges, are funded. Such an approach to developing financial plans will ensure that the organization gets the greatest economic return. In doing so, however, the organization may have to accept that there may also be political requirements to address.

One approach to allocate funding among different assets may be based on ensuring that the optimum performance rather than the maximum performance is achieved for each asset. In organizations with a mature asset management program, this approach can be developed through a performance management framework that links assets to strategic and funding priorities.

For example, should a bridge fall down, even if the pavement on both sides is new the road will be totally closed to traffic. Conversely, should the pavement on both sides of a new bridge be in drastically bad condition, the traffic over the bridge will be greatly affected. This example illustrates a holistic consideration from each asset group to meet wider strategic objectives on the same route. In such an approach, consistency can be achieved by considering a common level of service for that route. An alternative approach may be to consider the risk associated with the poor performance of an asset group on that route. Generally, pavement management and bridge management are key asset concerns that need to be looked at holistically. Pavement deterioration is visible to road users and may be more politically sensitive for road organizations. Bridge deterioration is managed in terms of the risk and criticality of that structure to the local and national economy.

Step 2 becomes a challenge when budgets are constrained and there is insufficient funding to meet the required performance or eliminate the backlog of maintenance, which is the case most of the time.

Step 3. Assessing financial sustainability

It is important that the financial plan preserves the value of the assets in the organization’s ownership as much as possible. It is accepted that investment in roads contributes to the economy through well-maintained accessible roads. Depending on the organization and its accounting practices, the financial plan may also impact the balance sheet of the organization. For example, if the financial plan does not maintain the network in steady state condition, but because of known funding constraints the plan is unable to arrest deterioration, then the value of the assets will depreciate. This may result in additional financial charges to the organizations in order to fund this depreciation. Asset valuation is described in greater detail in Chapter 3.3 Asset Valuation. Developing a financial plan that is sustainable should be one objective of the organization.

In the U.S., the assessment of the financial sustainability of the transportation system currently uses the GASB 34 modified approach. GASB 34 requires state and local governments to report the value of their infrastructure assets in their annual financial report on an accrual accounting basis. Under this method, the loss in value of an asset is spread across the asset’s useful lifetime. In this way, the budget for maintenance intervention appears in parallel with the amount of loss in asset depreciation. More maintenance should, normally, induce less asset depreciation. In other words, an increase in asset maintenance could be balanced, to a certain extent, by a decrease of asset depreciation.

This approach does not take into account the benefits of maintaining the infrastructure asset on the total cost, including transportation costs for freight and people, environmental impacts, etc., which a cost-benefit analysis (CBA) approach can. GASB 34 also does not take into account the risks inherent in the planning process (e.g., unexpected reduction of budget, growth of traffic, severe climate events), which risk analysis does. More recently (2012), the MAP-21 legislation has required local authorities to provide the following information (Applied Pavement Technology 2013):

With this legislation, it is recognized that assessing financial sustainability requires preliminary lifecycle cost considerations and risk management.

The financial plan describes the amount of funding expected over the next 3 to 5 years and where it will come from (eventually, component by component). Such plan documents any assumptions made in preparing the plan. Therefore, it will help to evaluate the uncertainties and risks affecting the expected budget.

Financial plans are prepared to inform the planning and management of an organization’s maintenance responsibilities (PIARC 2006). Financial plans should also be used to make the case to senior leaders for investment in transportation infrastructure. In order to secure the necessary funding, it is important that a robust business case is made for the investment needs. The case should be supported by including the appropriate transportation infrastructure information described in this guide. In addition, it is suggested that the consequences of underfunding by, say, 10 %, 20 %, and 30 % should be presented in terms of the following:

This information helps the decision making process for allocating funds because it considerably strengthens the business case for investment in the maintenance of highway structures.

Applied Pavement Technology, Inc. 2013. Minnesota DOT Work Plan for Developing a Transportation Asset Management Plan. Minnesota Department of Transportation (MnDOT) Asset Management Steering Committee and Project Management Team (PMT). St. Paul, Minnesota, US.

AMEC Environment & Infrastructure, Inc., Cambridge Systematics, Inc., "New York State DOT Work Plan for Developing a TAMP", FHWA, July 2013.

Ph. Lepert, "Road maintenance policy based on an expert asset management system - Concept and case study", SURF'2012, Norfolk, USA, September 2012.

PIARC 2006. An Overview of PIARC Studies on Financing Road System Investments, Alston, Sheri (https://www.piarc.org/ressources/publications/3/4849,RR332-IntroAlston.pdf).

PIARC, TC-D1.2, "High Level Management Indicators", PIARC report, Paris, France, October 2011

Ph. Lepert, F. Brillet, "The overall effects of road works on global warming gas emissions", 1361-9209/$ - Published by Elsevier Ltd., doi:10.1016/j.trd.2009.08.02.

A. Weninger-Vycudil , Ph. Lepert, "EVITA: Environmental Key Performances Indicators", EPAM3, Copenhagen, Malmö, Sweden, September 2012.

These practices have been tested in several instances and case studies are being prepared. They will be presented here when available. If you want to share a case study, please contact assetmanagementmanual@piarc.org.

The purpose of asset valuation is the calculation of the financial value of an organization's assets reported at the end of a financial period. The valuation of road infrastructure assets is a business reporting requirement for many transportation organizations and an important component for the financial management of roads. Road assets support economic growth, but this is not considered as part of an asset's value and is measured separately through investment planning, as discussed in Chapter 3.2. Asset valuation is therefore primarily an accounting exercise, but it should also be used by engineers to support investment planning.

The principle purpose of asset valuation is to document the financial value of the road infrastructure assets owned by an organization and included on the organization’s financial balance sheet. Placing a monetary value on road assets emphasizes their importance and the potential cost to replace them and to return them to new condition. This cost is reported through the depreciation of the road asset, which represents the consumption of the asset in delivering services to road users and other stakeholders. It is essential that asset valuation for road infrastructure assets comply with the financial reporting requirements relevant to that particular country.

Monitoring how the asset value changes with time can indicate if the investment required to maintain the appropriate value of the asset is being provided. As such, monitoring can provide compelling arguments for investing in the preservation of the asset base to senior decision makers in the organization.

Experience in some countries, such as Finland, New Zealand, Australia, the U.S. (AASHTO 2013), and Canada (TAC 2015), has shown that implementing financial reporting of asset values for infrastructure assets has a significant impact on how maintenance and renewal work is funded. This reporting has generally resulted in an improvement in the maintenance of assets.

Asset valuation may be required to support the financial reporting requirements of an organization. It also provides the opportunity to describe the importance of the road asset and investment in that asset in financial terms. This will provide senior decision makers with appropriate information to understand the financial implications of their decisions. It will also provide the opportunity for presenting the case for the development of more cost-effective maintenance and replacement programs that will maintain the value of the transportation asset (PIARC 2008-a). The benefits of adopting this approach include the following:

Roads are mostly publicly owned and unlike property assets, will not have a value if sold on the open market unless the buyer is permitted to recover their investment through mechanisms such as tolling. These assets are therefore not generally used for the purpose of revenue generation. Hence, the method to be adopted for asset valuation should not be based on market value or revenue stream. Exceptions may include concessions, toll roads, and the refinancing of design, build, and operate contracts, where roads operate more as a utility.

In order to support the business requirements of the organization, the method of calculation for asset value must follow the accounting standards of that organization. International Accounting Standard 16 is one of the accounting standards that may be adopted. It is also common practice that these standards are interpreted through codes of practice and other guidance and standards in order to be used for asset valuation.

The approached used to calculate the value of an asset must be repeatable and consistent because it is collected according to accounting rules and is subjected to robust internal controls and a formal audit regime. Applying these principles to the production of data for road assets not only ensures that the data is fit for use for reporting the value of the asset, but also provides high-quality information to support the management of the assets and maximize the value delivered from both past investment and future expenditure.

Within accounting, depreciation is used to provide a measure of the cost of the economic benefits embodied in an asset that have been consumed during the accounting period. Depreciation can be measured in various ways. For commercial undertakings, a key aim should be to reflect changes in market value or income generating potential, but for long-life public sector infrastructure, a more appropriate measure is what needs to be spent to maintain the asset in a stable condition. The principles of calculating asset depreciation and asset deterioration are not always the same. This may lead to differences in future asset investment and future asset value.

An historical cost-based approach to valuing road infrastructure assets may be used as a starting point. However, this approach is not a good basis for dealing with assets that have very long lives. It provides some information about what is being spent on the assets, though even this is not necessarily consistent between organizations, but it says nothing about the effect the expenditure has on the condition of the assets or how much it matches spending needs. For those organizations starting asset management, this may be adopted as a basis for providing some simple financial information.

A more advanced approach is to adopt depreciated replacement cost (DRC), which is a method of valuation that provides the current cost of replacing an asset with its modern equivalent asset, minus deductions for all physical deterioration and impairment. Gross replacement cost (GRC) is based on the cost of constructing an equivalent new asset, and the difference between the gross and depreciated cost is the cost of restoring the asset from its present condition to “as new” condition. Annual depreciation is calculated by identifying all the capital treatments needed to maintain assets or key components over their lifecycles and then spreading the total cost evenly over the number of years in the lifecycle. Calculated in this way, annual depreciation not only represents the annual consumption of service benefits, but also provides a measure of what, on average, needs to be spent year to year to maintain the assets in a steady state.

The methodology used to calculate the asset value depends on the asset under consideration. International Accounting Standard 16 requires that where an asset can be broken down into identifiable components with different useful lives, those components should be accounted for separately. For practical purposes, this means breaking assets down into their key parts at a sensible level of materiality, not trying to separately identify and account for every individual element. Components need to be distinguished in terms of those that have a finite life, at the end of which they will be replaced, and those that, given appropriate capital maintenance (replacement of subcomponents), will last indefinitely.

Assets need to be grouped in a consistent manner so that data can be aggregated for regional or national purposes, for example to determine actual expenditure or estimated spending need for a particular asset class, to allow organizations to benchmark performance against other organizations, and to allow individual organizations to track performance over time.

Classifications that may be used are shown in Table 3.3.5. The list is not exhaustive.

The levels in the table are defined as follows:

Level 1: Asset types include broad categories based on the general function of the assets. They divide the asset base into categories that may be suitable for reporting in the financial statement and that provide an appropriate a basis for high-level management information;

Level 2: Asset groups are used to distinguish between assets that have a similar function and form; and

Level 3: Components distinguish between asset components that may require individual depreciation models, e.g., to calculate different service lives and/or rates of deterioration.

Once the assets are divided into appropriate components, it is necessary to determine the expected or remainng life of each component or rehabilitation treatment. The useful life of individual components also determine whether or not it is appropriate to group components.

Assets and components fall into one of two categories: (1) those with a finite life, at the end of which they will need to be replaced, typically 20–40 years, although some assets will have considerably shorter or longer lives, and (2) those that, given the necessary capital expenditure, will have an indefinite life. Indefinite life components can be further subdivided into those that require capital maintenance to allow them to achieve their expected life and those that do not.

For a finite life asset or component, the lifecycle period will be the whole of the anticipated life. For an indefinite life component, the period will be based on the life of any capital treatments (PIARC 2005) necessary to keep it in use. Judgement needs to be applied here. If, for example, over time an asset would receive a number of cheaper, shorter-lasting treatments plus a single major, long lasting treatment, then the lifecycle should be based on the latter to ensure that the activities and costs captured are fully representative over the longer term.

If, exceptionally, a component that had been categorized as not requiring any treatments to maintain its life indefinitely does experience deterioration (for example, due to inadequate maintenance of surface layers), then it will need to be re-categorized and an appropriate lifecycle plan developed.

It is essential that assumptions about the remaining life of an asset, component, or treatment are reviewed annually and revised when necessary.

Rates used for the calculation of GRC should be the rates used for new construction and should the organization’s own rates. They should reflect actual rates at the time; proposed improvements in procurement or other factors that might lower rates in future years should not be anticipated.

In some cases, organizations may not have sufficiently recent rates of their own. This is most likely to arise with certain infrequent maintenance or replacement activities, for example when maintaining or replacing structures. For anything else, organizations should take appropriate steps to obtain a realistic estimate, for example by seeking rates from similar or neighbouring organizations.

Replacement costs should be the net of any residual (disposal) value of the asset or component. In most cases, disposal will be part of the replacement works and will therefore already be reflected in the unit cost rates. For example, in a street lighting replacement contract, the contractor will normally be responsible for removing and disposing of the old assets as well as installing the replacements, and the rates will take account of any scrap value. However, when that is not the case, any residual value will need to be netted off from the replacement costs.

Condition or performance data needs to be collected with sufficient frequency and consistency to provide a representative view of the condition of the asset and to track how this changes over time. The data can then be used to support deterioration modelling.

In many cases, organizations may not know the age of an asset or component or how long ago a particular capital treatment was carried out. In these cases, it is necessary to use condition as a basis for estimating age, e.g. the asset is rated at 7 our of 10 and for assets that have been subjected to a similar rehabilitation treatment, it would be expected that with a condition rating of 7, the asset would be 5 years of age. Deterioration modelling is important in estimating and then monitoring the future performance of an asset or treatment, in particular when the asset will need to be replaced or treatments carried out (PIARC 2003, PIARC 2008-b).

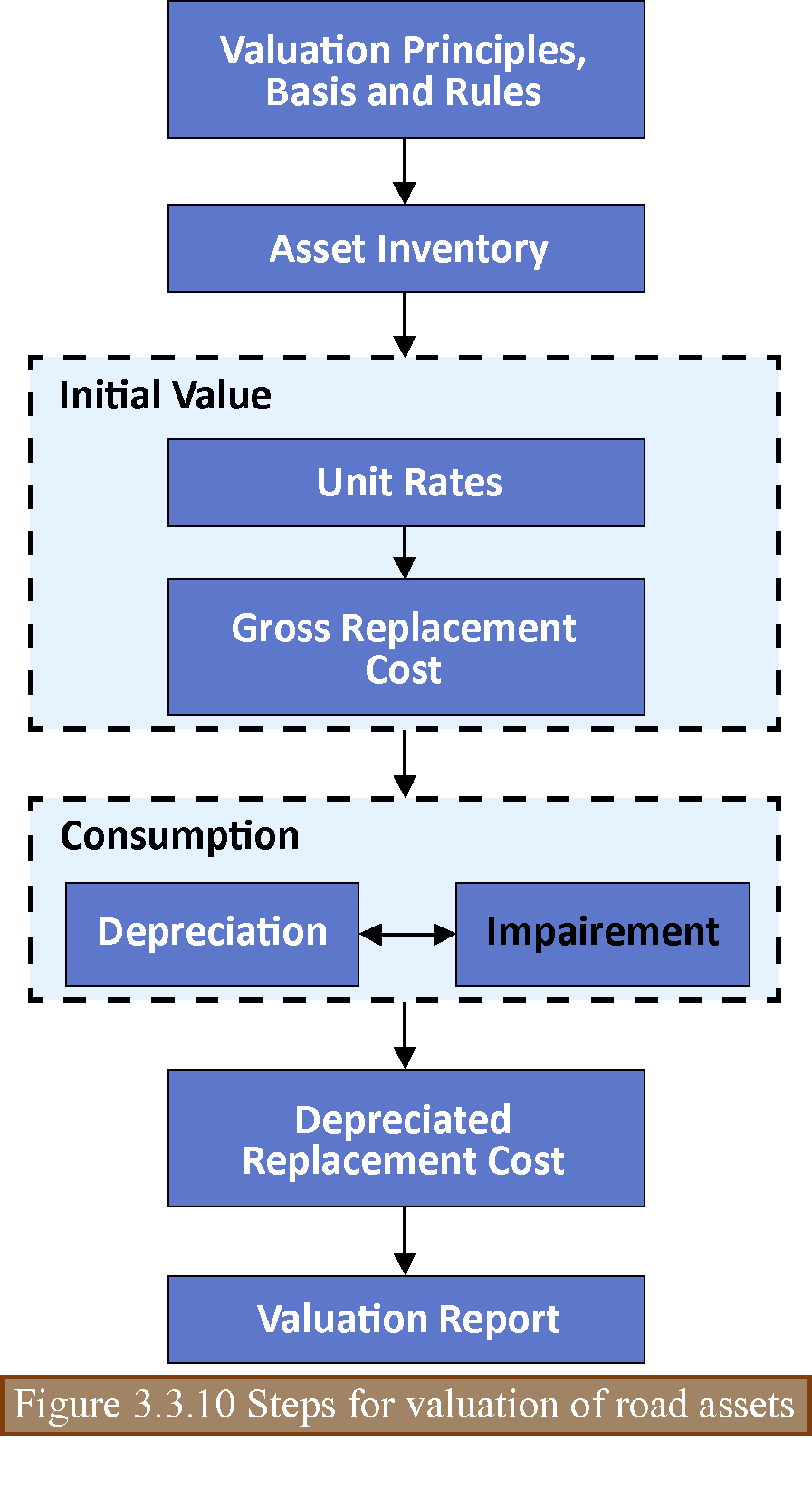

The general procedure for the valuation of road infrastructure assets consists of the following steps:

1. Establish the principles, basis, and rules for asset valuation. These should comply with the valuation requirements provided.

2. Compile an asset inventory that provides the base data for calculating asset values for all road infrastructure assets.

3.Calculate the initial value of the road infrastructure assets. This involves the following:

4. Calculate the consumption of the assets, which involves the following:

5. Calculate the depreciated replacement cost, which involves the following:

6. Prepare the valuation report.

Key aspects of these steps are shown in Figure 3.3.10 and defined below.

A summary of the key steps for the valuation of roadway assets are as follows:

Assets should be subject to full revaluation at least once every five years. In between revaluations, normally on an annual basis, the valuation report can be adjusted using appropriate price indices.

AASHTO 2013. Transportation Asset Management Guide – A focus on Implementation. American Association of State Highway and Transportation Officials, Washington, D.C.

CIPFA 2010. Code of Practice on Transport Infrastructure Assets. Chartered Institute of Public Finance and Accountancy.

PIARC 2003. Indicators for Bridge Performance and Prioritization of Bridge Actions, Committee on Bridges and Other Structures, ISBN 2-84060-161-3 (https://www.piarc.org/en/order-library/4504-en-Indicators%20for%20Bridge%20Performance%20and%20Prioritization%20of%20Bridge%20Actions.htm).

PIARC 2005. Evaluation and funding of road maintenance in PIARC member countries, Committee on Financing and Economic Evaluation, ISBN 2-84060-182-6 (https://www.piarc.org/en/order-library/4546-en-Evaluation%20and%20funding%20of%20road%20maintenance%20in%20PIARC%20member%20countries.htm).

PIARC 2008-a. Asset management practice, Committee on Management of Road Infrastructure Assets (4.1), ISBN 284060-211-3 (https://www.piarc.org/en/order-library/6014-en-Asset%20management%20practice.htm).

PIARC 2008-b. Indicators representative of the condition of geotechnical structures for road asset management, Committee on Earthworks, Drainage and Subgrade (4.5), ISBN: 2-84060-301-6 (https://www.piarc.org/en/order-library/5780-en-Indicators%20representative%20of%20the%20condition%20of%20geotechnical%20structures%20for%20road%20asset%20management.htm).

TAC 2015. Synthesis of Asset Management Best Practices for Canada. Transportation Association of Canada, Ottawa, Ontario

CARLOS RUIZ TREVIZAN, National Highways Laboratory Department, Highway office, Chile

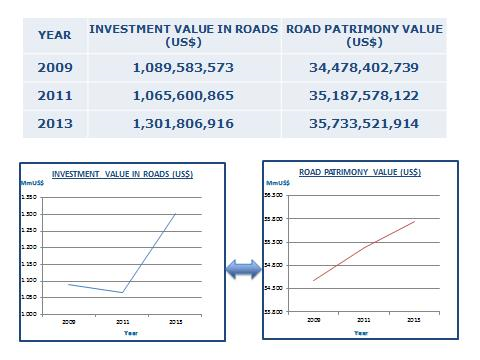

An important component of Road Infrastructure Management is the Valorization of the Road Patrimony. It has been shown that the annual calculation of road assets enables government agencies to monitor infrastructure and minimize the loss of value of it associated with causes such as physical deterioration, underutilization or security risks. In addition to the above, the value of the Road Patrimony makes it easier for the agencies to make investment decisions as well as justifying the necessary amounts of investment in conservation of the Road infrastructure. In this way, the impact of the investments made by the State on its infrastructure that is under the direct tuition of the road agency can be determined, so that the works and conservation actions result in an increase or, at least, the maintenance of the Road Patrimony.

To calculate the Road Patrimony it is necessary to define a clear and concise methodology to achieve the objective, for which the National Directorate of Roads of Chile, due to modifications that have been made to determine the condition of the paved roads, considered necessary to update the current method of calculation, which is recommended by the Economic Commission for Latin America and the Caribbean (ECLAC) of the United Nations, for which during 2014 it hired a Consulting Company to carry out the Basic Study: "Methodology for the Determination of the Road Patrimony".

In this Basic Study the analysis, results and main conclusions were made regarding the determination of the Value of the Road Patrimony for the year 2013 according to a new methodology, where the calculation methods, the basic concepts, the databases and the program were updated computational for practical use. Depreciation methods were also determined in relation to climatic variables, traffic and in relation to their conservation, in addition new road assets were incorporated to consider all those under the administration of the National Directorate of Roads of Chile. For this calculation, the antecedents of the year 2013 of the paved national road network and the unpaved network were taken into account, considering also bridges, tunnels, bikeways and footbridges.

The PATVIAL 2.0 software, a computational application developed in this Basic Study, is used to calculate the Road Patrimony. This software automates the methodology used, regarding the entry and validation of data, determination of the value of the Road Patrimony, and analysis of results, according to the availability of information and the objectives of the project.

The calculation of the patrimony value of the paved and unpaved road network, excluding the road network under the concession system, in this Study was made for the years 2007, 2009 and 2011. In this way, information such can be obtained as the following Figure 3.3.12.1:

The correlation can be obtained between the levels of investment, disaggregated in conservation as such and investment in changes of standards with the variation of the patrimony value, is a powerful indicator of the degree that reaches the management of road infrastructure from the standpoint of efficiency and effectiveness in the use of public resources.

This area of road infrastructure management is currently being strengthened with various tasks aimed at systematizing the process of determining road assets, in particular 9 types of road assets have been defined, their design life, residual useful life and criteria for reevaluation. This process is part of the need assumed by the State of Chile with the Organization for Economic Cooperation and Development (OECD) in the sense of implementing the International Accounting Standards in the Public Sector through the instructions derived and led by the General Comptroller of the Republic, is why the NICSP-CGR as they are known by its acronyms, has generated a calendar of activities that should conclude the year 2021 with the determination of the patrimony value of the road infrastructure of the whole country under a system semi-automated calculation.

The design of the patrimony value system is completely inserted in the Road Asset Management system, so it will be fed from the databases that are updated based on the information from the visual inspections, the actions on the road infrastructure, whether they are conservation or improvement activities and the financial information to capture the capitalizable expenditures that will go directly to increase the patrimony value or the necessary expense for the administration of the accounting assets.

The implementation of this indicator will require adjusting different systems, already underway, but without a doubt the internal processes will be strengthened, giving value to many intermediate activities of the entire process of asset management.

More information can be found on the website of the National Directorate of Roads of Chile, in the area of the Road Management Department, according to the link: http://www.vialidad.cl/areasdevialidad/gestionvial/Paginas/Informesyestudios.aspx .

The works programming / resource allocation activity defines (PIARC 2012-a) the steps necessary to identify and prioritize the projects that should be carried out in the short and medium term to support the asset management strategy. At the same time, it provides mechanisms to distribute the available budgets among the identified projects in order to realize benefits such as increased safety, mobility and comfort, value for money, and risk mitigation.

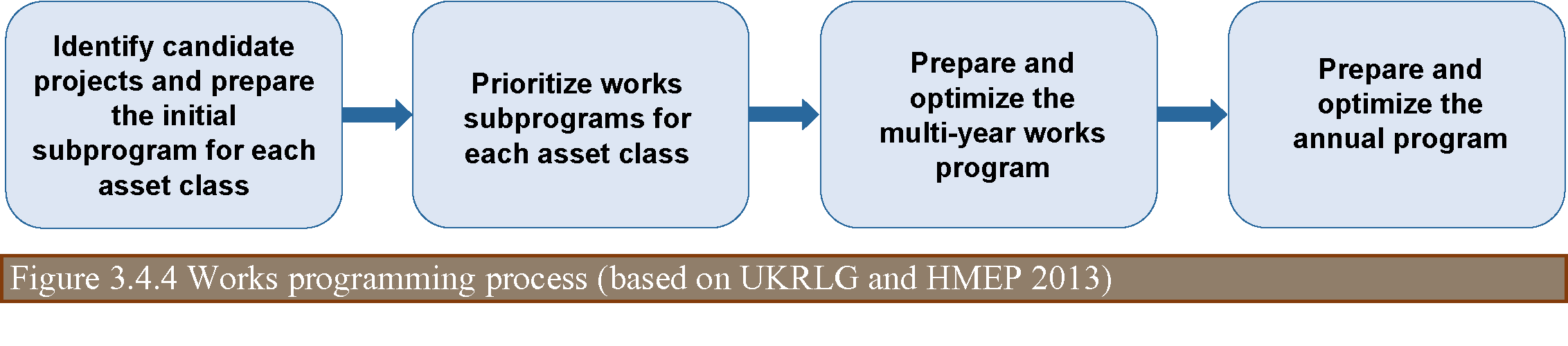

Besides explaining the basics and motivation of works programming and the maturity levels associated with it, this chapter presents a detailed description of the works programming process, which includes the following tasks: identify candidate projects and prepare works subprograms by asset class; prioritize the asset class subprograms; prepare and optimize a multi-year works program for a programming period of 3 to 5 years; and prepare and optimize the annual program. The above process should be revised on regular basis to ensure the proposed annual program effectively contributes to achieve the organization strategic objectives.

Works programming refers to the preparation of annual and multi-annual works programs in which road assets requiring treatment are identified, selected, and prioritized and resources are allocated from available funds (Robinson et al. 1998).

Programming implies the application of asset management principles to make decisions at the network or subnetwork level for budget allocation in the short to medium term. Assuming that appropriate levels of service have been set, this process includes identifying asset requirements, developing a total needs program, and prioritizing/optimizing programs for the existent budget constraints (Austroads 2009).

The preparation of works programs has at its core a resource allocation process, which ideally distributes the available funding among projects that have been identified as the best alternatives for investing funds (PIARC 2000). Best practice includes the application of benefit-cost analysis for each candidate project within a lifecycle framework. Modern analysis tools are based on such a framework and provide mathematical optimization routines to determine the best investment choices subject to limited budgets (Cambridge Systematics 2004).

While the economic factor is important, it is not the only criterion used for selecting projects. Other aspects that may also be considered are network connectivity, neighborhood cohesion, preservation of corridor standards, and economic necessity (Cambridge Systematics et al. 2002-1).

At high levels of maturity in asset management, works programming also considers risk and thus applies a risk-based approach when carrying out tasks like identifying candidate projects or prioritizing works programs by road asset (UKRLG and HMEP 2013). In addition, mature works programming features resource allocation across asset classes, which is often implemented using risk criteria as well.

In developing works programs, it is important to make sure that treatment options, intervention criteria, and system priorities comply with established strategic directions (Austroads 2009).

The main goals of the works programming process include the following (Austroads 2002 and UKRLG and HMEP 2013):

Program effectiveness is measured in terms of the program’s contribution to achieving asset management policy and strategic goals, attaining performance targets (PIARC 2012-b) defined by the road organization and meeting the expectations of stakeholders. The efficiency of programs is determined as a function of the benefits generated (user cost savings, improved road safety, congestion reduction, and so on) per investment unit.

Works programs and the associated performance measures and targets, when made publicly available, also provide means for increasing the accountability and transparency of the agency operations.

Ultimately, the goal of works programming in asset management is to deploy, maintain, and operate assets in a manner that maximizes the accomplishment of the organization’s mission (FHWA Transportation Asset Management Expert Task Group 2013).

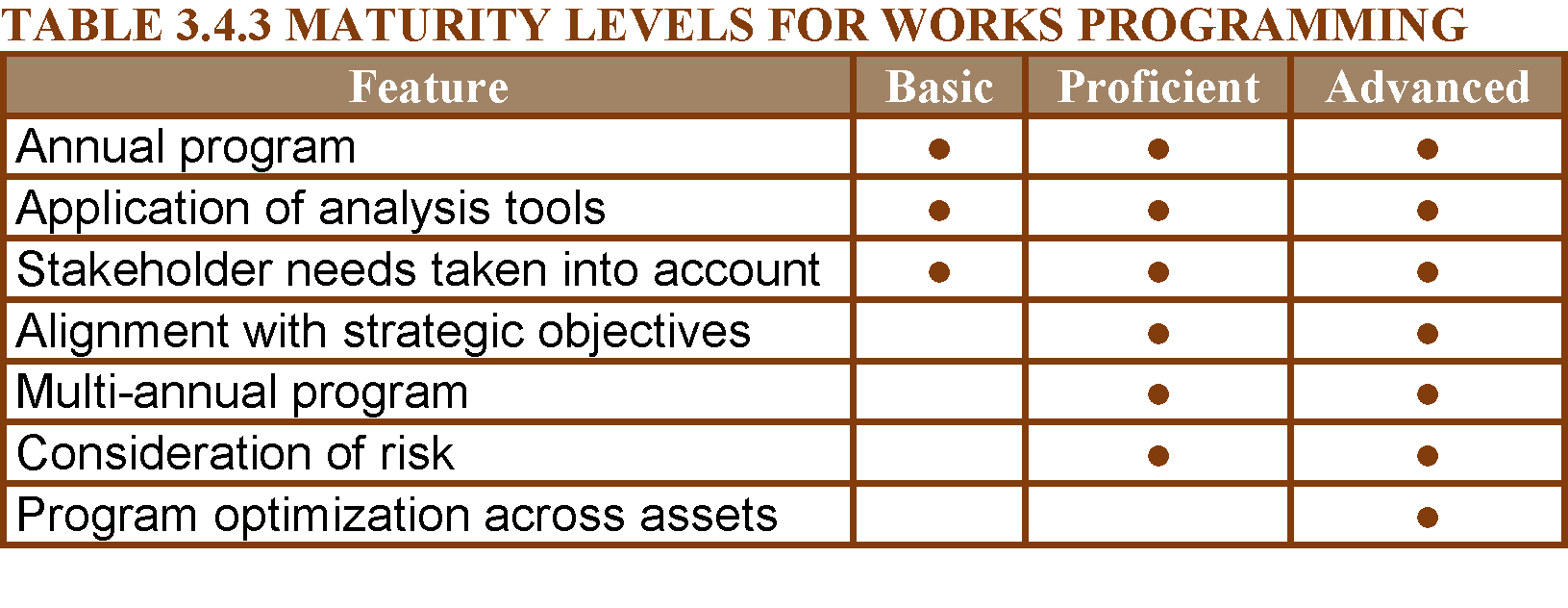

The level of maturity for works programming can be assessed based on a number of features, such as the length of the programming period, application of analysis tools, or resource distribution across asset classes. In this way, for each maturity level a particular feature may or may not be present, as shown in Table 3.4.3. Maturity levels can then be characterized by the set of features they support.

The following sections present a brief discussion of maturity levels with regard to the programming process.

A basic approach to programming normally allows for the production of annual works programs only. At this maturity level, organizational barriers still exist that limit the use of strategic objectives and other elements of planning to support longer programming periods. Another restricting factor for the development of multi-annual programs is a high level of uncertainty with respect to future revenue.

Though analysis tools are present at the basic maturity level, organizations at this stage tend to privilege the implementation of such tools over the improvement of the business process they should support, thus reducing the potential impact that tool use may have on the overall performance of the organization. Nevertheless, at this level return on investment might be used as a basis for decision making when this capability is built into the tools employed.

Also, at the basic level performance models within management systems are frequently not developed or calibrated to an appropriate degree to ensure that local conditions are properly simulated. In this respect, it should be emphasized that all performance models used in asset management systems (road deterioration, traffic assignment, vehicle operating costs, etc.) should be carefully adjusted to local conditions. Using default models, as is done in a number of countries due to economic or technical issues, should be discouraged if not prohibited because all medium- and long-term results from studies such as benefit-cost analysis or risk analysis are strongly dependent on the relevance of the models.

Most management systems in operation at the basic level support works programming only for pavements and, to a lesser extent, for bridges. Budget allocation for assets other than pavements or bridges are often carried out based on historical expenses.

Finally, because management of stakeholders’ expectations is usually also at an early stage, pressure may arise to favor projects addressing the needs of specific groups or projects with special political significance at the expense of other projects with better potential to achieve the goals of the road organization.

A distinctive feature of proficient organizations with respect to works programming is their ability to support development of multi-year work programs. These organizations have typically succeeded in reaching a proficient level in other aspects of asset management, including data management, lifecycle planning, and performance management.

The above is evidenced by the existence of more reliable information and tools. These allow road managers to expand the programming time horizon, which is also leveraged by an increased commitment from senior executives to use business cases effectively in securing funds for road investment over longer periods.

Pavement and bridge management systems are well established as corporate tools, and their application is aligned with the business processes the agency has implemented for allocating resources. Other systems for managing slopes and/or embankments, accidents, and signs may have already been deployed. Evaluation and prioritization of treatment options are based on benefit-cost analysis, particularly in the case of pavements.

At the proficient level, risk is used as an additional criterion to identify and prioritize candidate projects for assets such as bridges, earthworks, and drainage or for projects related to road safety. Risk may also be taken into account to manage sources of uncertainty affecting program delivery, including costs, funding levels, and adverse environmental events. Risk management is an additional factor enabling the agency to prepare multi-year works programs.

This level also features mechanisms for managing stakeholder expectations so that the needs of particular groups are properly balanced with the strategic objectives of the road organization. At the same time, new means for capturing customer perception, such as road user surveys, are put into practice.

Organizations at this stage of maturity have successfully incorporated asset management into their corporate culture and are immersed in a continuous improvement process. In this context, they investigate further actions to enhance the efficacy and efficiency of their business practices.

One of these actions is the implementation of a cross-asset schema for budget allocation, which broadens the scope of project selection and prioritization to ensure that projects that best contribute to the organization’s mission are adequately funded, regardless of the asset class or operational feature each project is related to. A prerequisite for an organization to implement cross-asset resource allocation procedures is the existence of a suitable organizational structure for allowing the steady flow of information that might be required.

Cross-asset methods are still at an early stage of development worldwide. In this regard, risk-based approaches have also proven useful for organizations already engaged in adopting such methods.

Advanced works programming is closely linked to asset management financial planning. On the one hand, financial planning takes as input information regarding historical funding levels and the amount of funds expected to be available in the foreseeable future (FHWA 2013). On the other hand, it defines how these funds will be allocated in the short to medium term.

The overall process of developing works programs and allocating resources to individual projects can be depicted as a sequence of stages, as shown in Figure 3.4.4.

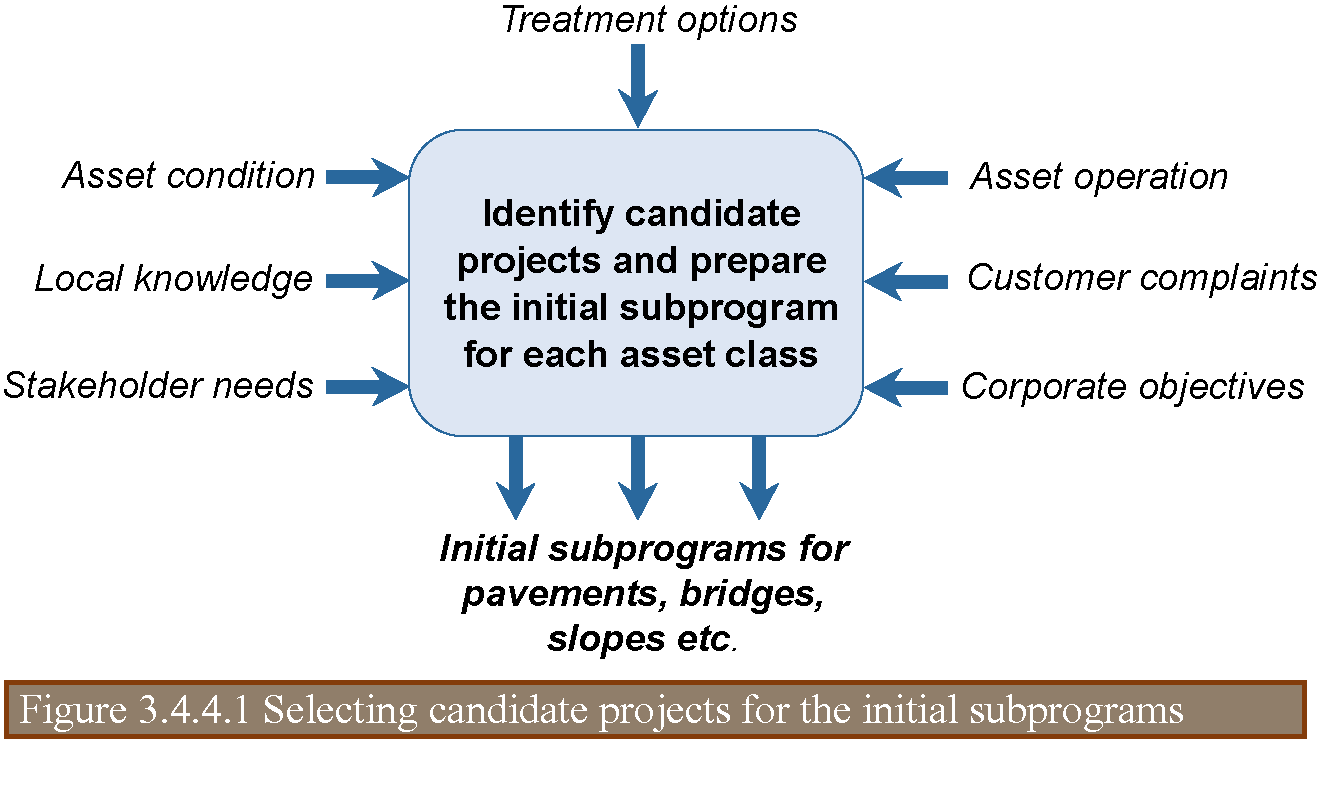

The identification of candidate projects implies the analysis of a given asset (e.g., a pavement section or a bridge) to determine what actions, if any, should be taken to maintain or improve its performance (Cambridge Systematics et al. 2002-2). This analysis relies on information sources like the following: condition surveys, safety inspections, knowledge of local staff, stakeholder needs, accident claims, and requirements to meet corporate objectives. Data from condition surveys and safety inspections should ideally be available from the asset management system, in some cases through advanced platforms such as GIS (UKRLG and HMEP 2013)

A comprehensive approach to project identification may include the following steps (Austroads 2002):

In order to define the projects required to close the gaps identified from the above steps, several treatment alternatives may be evaluated for each asset. Road management systems such as pavement, bridge, accident, and other management systems have been developed over the years to streamline the analysis of alternative works. At this stage, evaluation may include assessing the economic benefits of each option, particularly in the case of pavement assets.

The final lists of candidate projects obtained by identifying the optimal intervention option for the various assets may be referred to as the total needs program (Austroads 2009). Figure 3.4.4.1 contains a simplified representation of the programing stage concerning project identification and the preparation of initial programs.

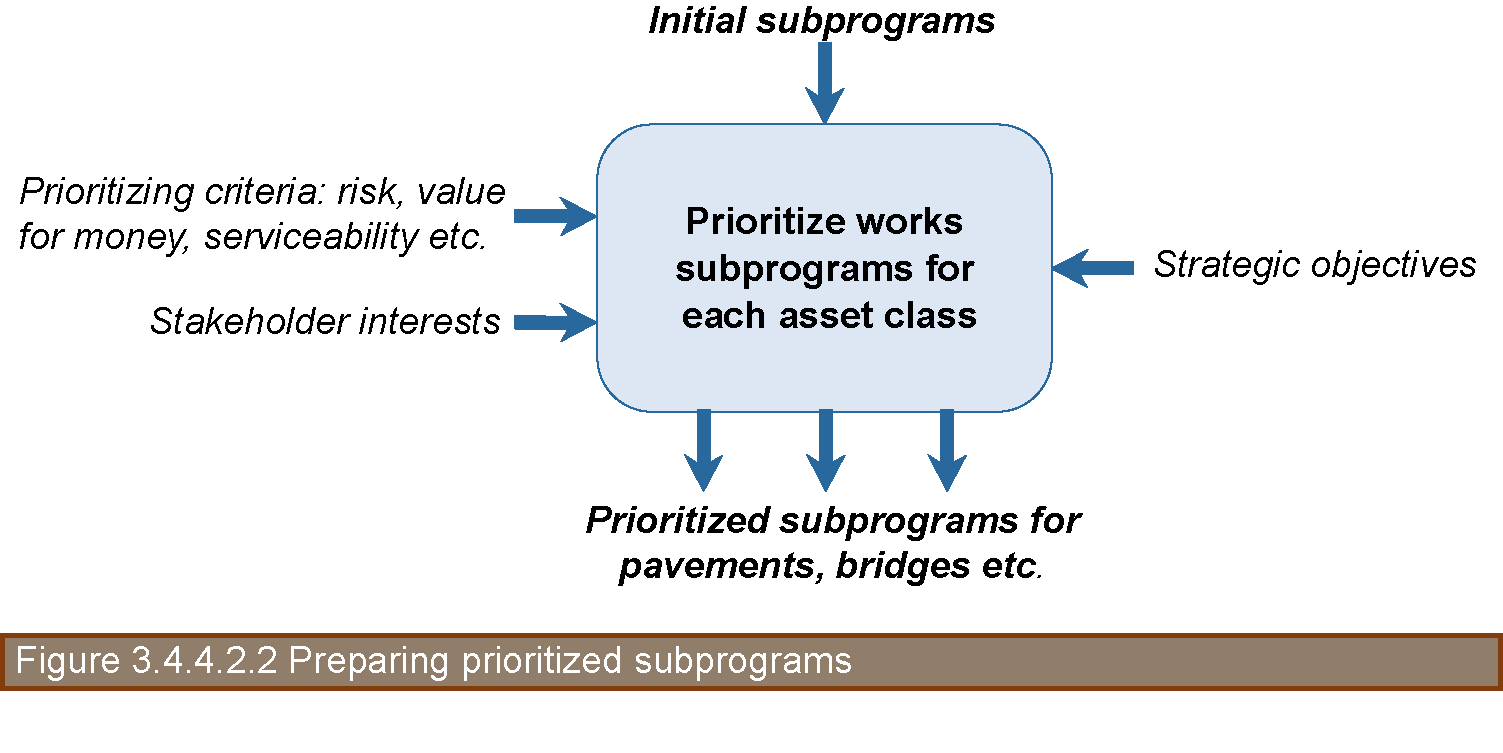

Prioritization is basically a method of arranging proposals on new lists that indicate which projects are to be funded first (Austroads 2009). Each new list corresponds to a prioritized subprogram per asset class. The prioritization process is built upon a set of criteria involving aspects such as physical condition, safety, risk, and economic feasibility.

The initial works program usually includes assets whose performance has fallen below specified standards in terms of condition or safety measures. It may also comprise assets subject to high levels of risk, such as those located in areas of extreme weather conditions as well as those attracting the interest of stakeholders for other reasons (e.g., political or socioeconomic).

Because available budgets will in most cases be insufficient to address all needs, safety-critical assets or those having the highest level of risk (Figure 3.4.4.2.1) will normally be put at the top of the list.

Candidate projects should also be prioritized depending on their lifecycle return on investment to ensure that value for money is achieved, particularly in the case of assets such as pavements, structures, or lighting (UKRLG and HMEP 2013). Again, road management systems usually help performing this task.

Modern prioritization procedures call for applying a multi-criteria approach in which factors such as sustainability, stakeholder requirements, and social benefits are combined with serviceability, safety, and value for money. This approach requires assigning appropriate weights to each factor depending on the institutional vision.

It should be noted that agencies at the proficient maturity level might not be in a position to apply the multi-criteria approach described above, while agencies at the basic level usually only use serviceability and economic return as criteria for prioritizing.

Inputs and outputs of the prioritization stage are illustrated in Figure 3.4.4.2.2.

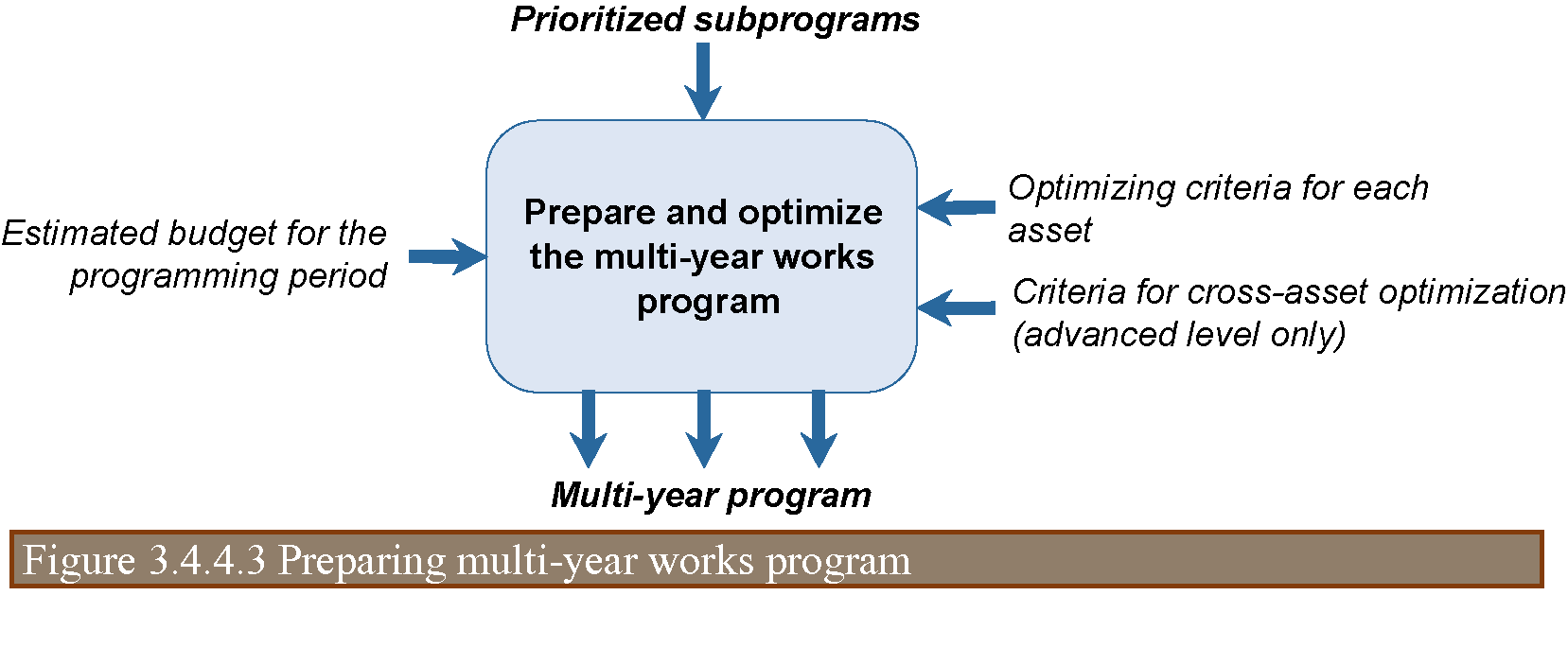

Multi-year programs comprise projects for the various asset classes to be executed within periods from three to five years (UKRLG and HMEP 2013). When information is available, programs can be developed for longer periods, e.g., 10 or more years. The preparation of multi-year programs is an essential phase of the programming process where project-level needs are reconciled with network-level resource constraints and performance goals.

The multi-year program supports financial planning by demonstrating what projects needs to be done and where and when they are to be undertaken. This planning must be reviewed annually and updated using the latest information available.

A multi-year program should indicate the amounts of funding corresponding to routine, preventive, and periodic maintenance, as well as resources intended for rehabilitation and construction (Austroads 2009). It should also contain details of the specific works considered for budget allocation. These features may be challenged by senior decision makers, so multi-year programs need to be robust and based on reliable information.

The list of projects to be included in the multi-year program is compiled by selecting projects from the prioritized program and adding up the costs estimated for each project until the forecasted budget is exhausted. At the advanced maturity level, the asset management plan and the investment strategy serve as a basis for determining which projects should be selected.

For projects around the budget ceiling or those requiring significant investment, additional data may be required to verify any assumptions made. The actual benefits from obtaining these data should be carefully assessed when the costs and risks involved are significant (UKRLG and HMEP 2013).

Project selection from prioritized programs often involves an optimization process. In this context, optimization refers to selecting investment options from various alternatives with the aim of achieving the highest benefits from constrained resource levels (Austroads 2009). One of the ranking criteria used for optimizing the available budget is the incremental benefit-cost ratio, which seeks to maximize the economic benefits for each additional unit of expenditure (Morosiuk et al. 2006).

Various management systems provide optimization modules for conducting impact analyses of different funding scenarios (Austroads 2009). Scenarios that might be considered include current constrained funds, incremented funds, reduced funds, and changes in the level of service offered. Results can then be presented to senior management to either support a particular funding scenario or examine various scenario options.

In performing program optimization, considerations such as the following may also be addressed (UKRLG and HMEP 2013):

Optimization of works programs has been traditionally carried out separately for the various asset classes, with a different budget ceiling established for each class. Using this approach, the resulting multi-annual program is actually made up of as many subprograms as the number of asset classes included in the programming process. Organizations at the advanced maturity level of asset management consider the implementation of methods for optimizing resource allocation across asset classes, using optimization processes based on a multi-criteria approach similar to that described for the prioritization stage.

Figure 3.4.4.3 shows the main information flows occurring at this stage of the programming process.

As mentioned above, organizations at the basic level only support development of annual works programs. In this case, the preparation and optimization of the multi-annual program is omitted or, more precisely, the tasks described above are performed using an analysis period of one year, and cross-asset optimization is not addressed.

The multi-annual program should be reviewed annually to update the list of projects with the highest priority that can be delivered from the available budget and produce an annual works program or annual plan (UKRLG and HMEP 2013).

In generating the annual program, consideration must be given to projects deferred in the last year, the backlog of needs, and the updated availability of resources (Austroads 2009). Projects in the annual works program should already have undergone a detailed design process and be ready for delivery. This enables contractors to plan the works properly and minimize any potential risks. In project design, the collection of additional detailed data on the involved assets should be considered to ensure that the proposed intervention produces the expected outcomes. Also, a more detailed cost estimate for each project should be made allowing a suitable contingency for risk (UKRLG and HMEP 2013).

Paragraph 3.4.4.3 introduces cross-asset allocation as a means of distributing resources among asset classes during the optimization of multi-year works programs. Actually, from a conceptual point of view, cross-asset allocation constitutes a complete programming approach on its own that makes use of advanced asset management components such as strategy, performance and risk. The following paragraphs discuss the concept of cross-asset allocation, and its potential as an effective tool for achieving the strategic goals of road organizations. Also, a procedure based on the international experience in applying this approach is outlined.

Cross-asset allocation involves the distribution of resources among road investment programs in order to realize the strategic objectives of the organization responsible (see paragraph 1.4.4.1). An investment program may refer to any works program intended to maintain or improve asset condition, but also to impact other performance areas such as safety, mobility or sustainability. In general, road attributes modifiable through investment programs may be designated as “drivers for renewal / maintenance” (AM4INFRA 2019).

The allocation of resource among investment programs is a complex task that starts with determining optimal solutions for single assets / operational issues. Many organizations have implemented advanced management systems for pavements, bridges and road safety, but only a few of them have appropriate tools for other areas. Since asset management implies assessing the level of service of a road network as a whole, the next step should be allocating constrained resources across the various investment programs. A question immediately arises: what (consistent) measures should be used to compare the benefits of the different programs among them?

During the 2009-2012 cycle, the PIARC technical committee on asset management carried out a study to identify the main approaches used by member countries to allocate resources among different assets (PIARC 2012-b). The study showed that the most common distribution method remained a percentage split of budget based on historical allocation. Nevertheless, road organizations already had envisaged the future use of more formal methods such as risk ranking, comparison of economic indicators (NPV, BCR and IRR), and multicriteria analysis.

Later on, the implementation of holistic asset management in a number of countries worldwide, led to the application of increasingly sophisticated procedures for coordinating, prioritizing and optimizing all maintenance activities on the different asset classes, as found by PIARC technical committee on asset management that worked through the 2013-2015 cycle (PIARC 2016). The study carried out by this committee quotes a Trans-European ENR research project known as PROCROSS, which identified three basic approaches to cross-asset allocation used in European countries (ENR 2012): bottom-up, top-down, and a combination of these. According to the project, all three approaches are valid and consistent in finding an optimum solution based on existing preconditions

A general description of the approaches identified by PROCROSS is presented in paragraph 3.4.5.3.

As pointed out in section 1.2, many road organizations around the world still operate under a silo-like structure, in which the various physical and operational issues like pavement condition or mobility are managed separately with a limited consideration of the organization strategic objectives.

Adverse effects of the traditional practice include (Deix, Alten, & Weninger-Vycudil, 2012):

Cross-asset allocation has been conceived to overcome disadvantages such as the above. In contrast with traditional methods, a cross-asset approach provides means for analyzing concurrently the benefits from different investment alternatives for each asset / operational issue so that the strategic objectives are attained more effectively and efficiently.

As mentioned previously, the ENR PROCROSS project identified the following approaches to cross-asset allocation as part as the asset management practice in Europe:

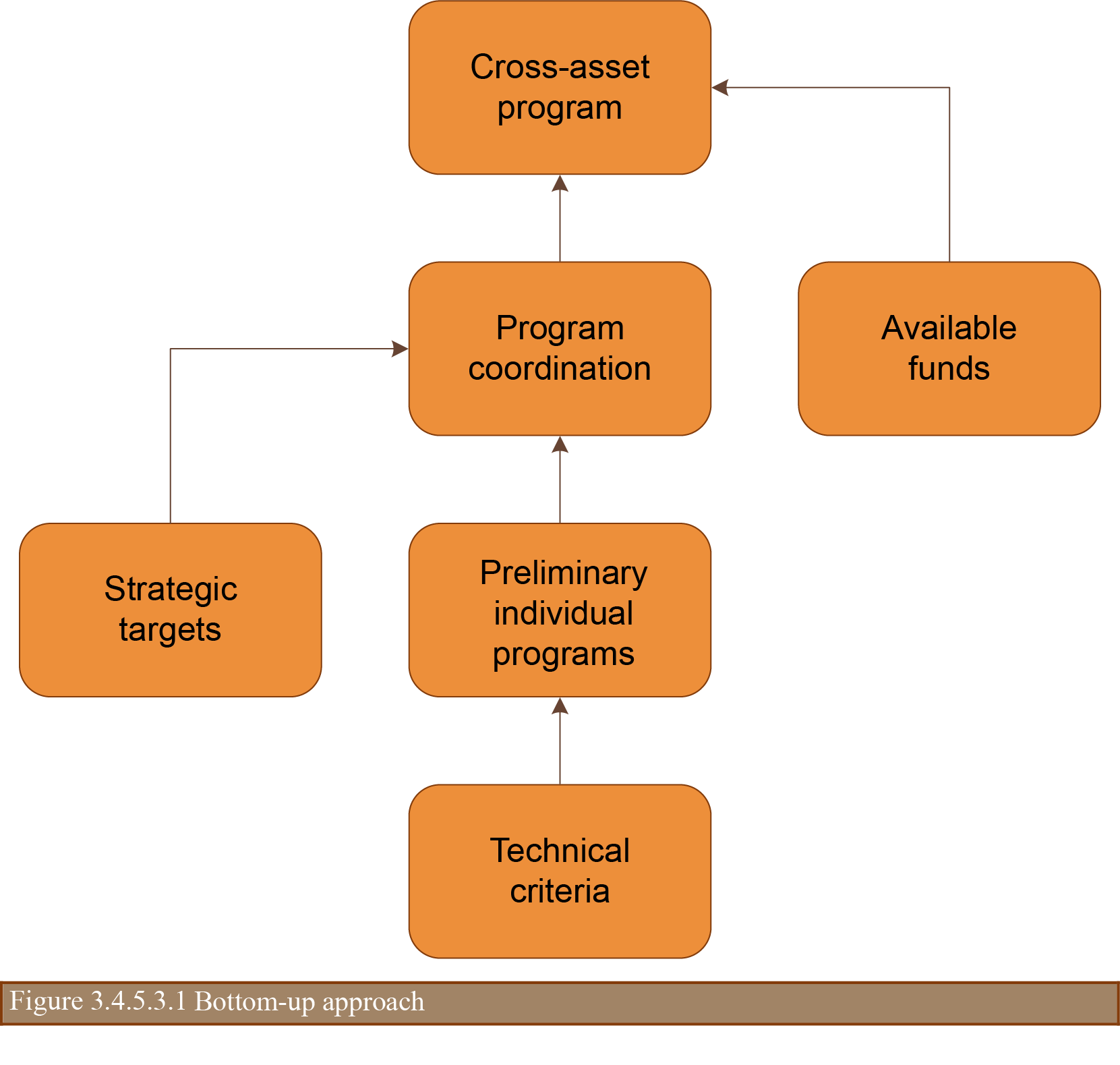

Bottom-up approach. This first method, portrayed in figure 3.4.5.3.1, is strongly influenced by the technical assessment of individual groups of assets / projects. Usually, each single group is analyzed separately by specific management systems that facilitate selection of appropriate alternatives under a certain number of given monetary or non-monetary preconditions.

The cross-asset process is usually not carried out at this application level, but the results can be used in a subsequent process of “coordination” across the individual groups. This process recalls the strategic objectives and targets, and may alter significantly the technically optimal solutions originally found.

The comprehensive appraisal of asset technical need constitutes the main advantage of the bottom-up approach. However, this feature represents also its main weakness since the focus on technical aspects leave the strategic objectives only rudimentarily considered.

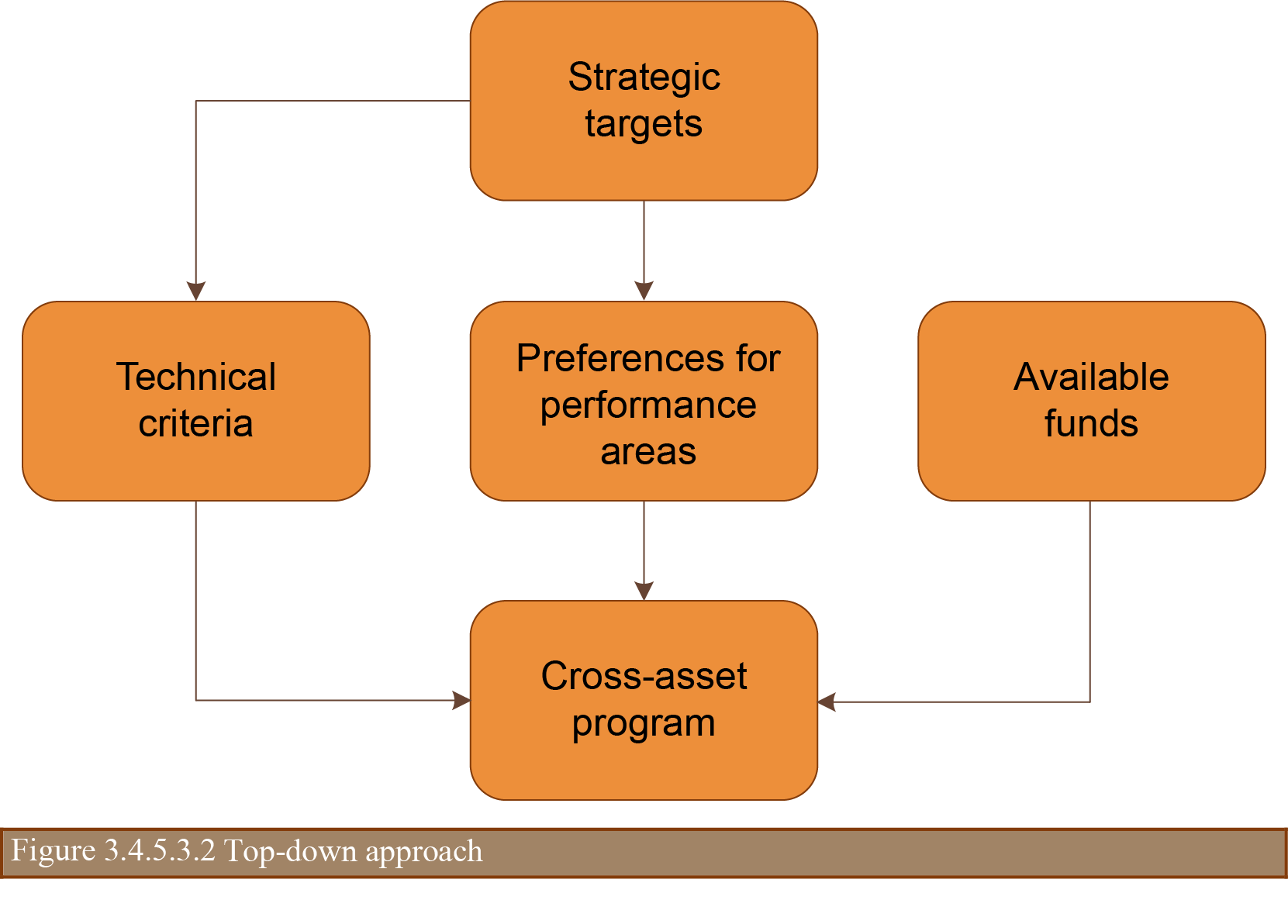

Top-down approach. According to PROCROSS definitions, a top-down approach (Figure 3.4.5.3.2) is based on high-level, central decisions that consider the road network as a whole. It assumes that the overall performance of the network can be improved if its various assets / attributes are addressed concurrently rather than on a single basis.

The application of a top-down approach requires a deep understanding of the performance of the network, in order to give preference to those programs that better contribute to achieve the desired or feasible strategic targets.

A top-down approach provides clear and comprehensive criteria for analyzing assets at the technical level. However, this does not imply that engineering considerations are applied to the necessary extent, which increment risks related to achieving the levels of service pursued.

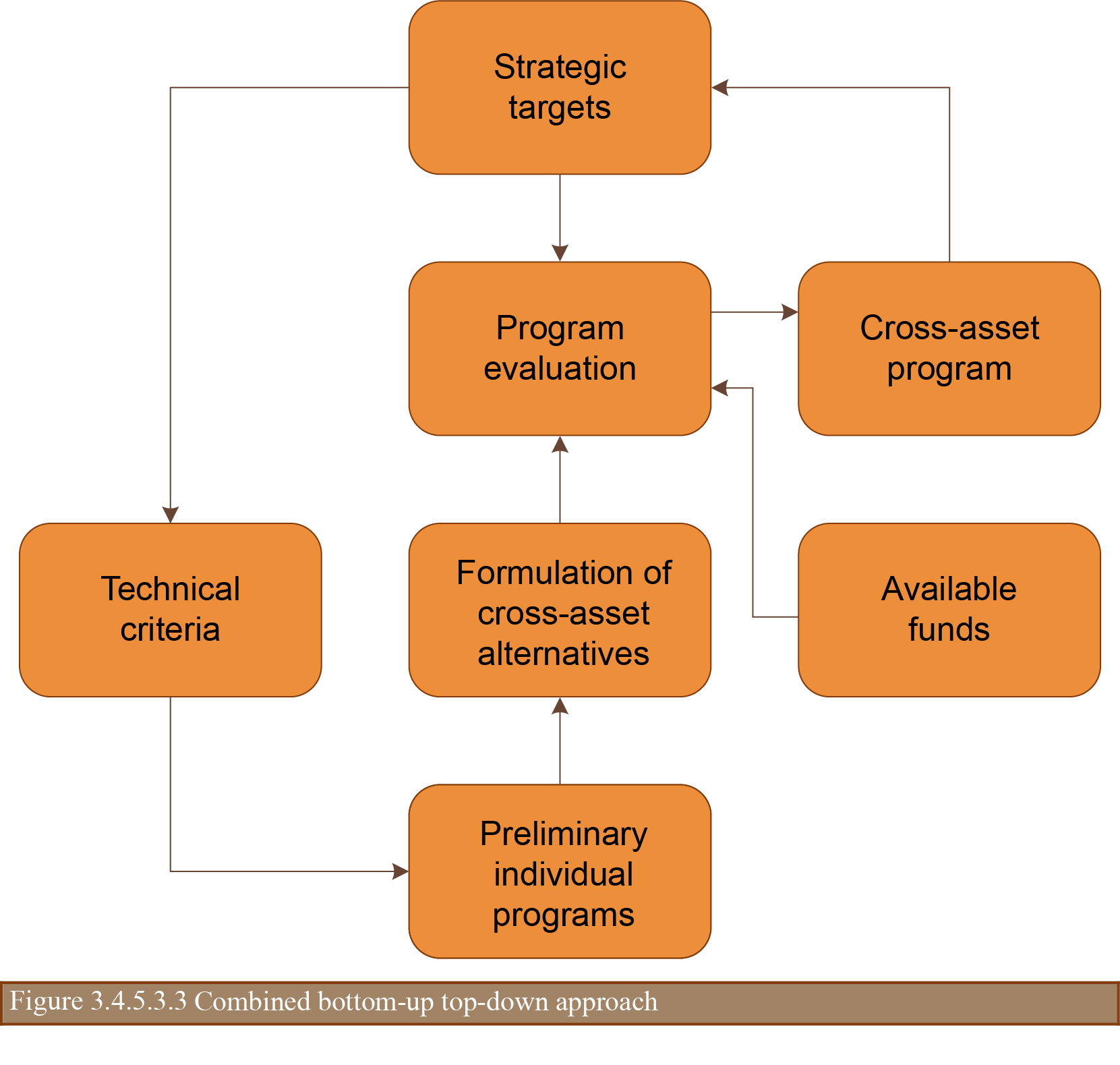

Combined approach. A combined bottom-up top-down approach, as represented in figure 3.4.5.3.3, entails the evaluation of the technical results of single assets in terms of the organization’s strategic targets. A critical issue for this approach is conciliating the strategic and the engineering requirements.

In the combined approach, the cross-asset allocation process usually occurs at an intermediate level between the strategic and the project levels. Under this approach, one the main objectives of works programming consists in harmonizing the strategic targets and the technical specifications by finding an optimal point that maximizes the fulfillment of the strategic objectives while reducing as much as possible the risk associated with the actual level of service provided. This is not an easy task as projects often do not comply with strategic criteria because they come as a result of a prioritization / optimization process that relies mainly on simple ranking and not from a network-wide performance analysis.

The final report of the PROCROSS project (ENR 2012) includes a specific cross-asset allocation procedure, which is based in the combined approach described above and comprises the following activities:

A procedure for cross-asset allocation is also provided in the Report 806 of the US National Cooperative Highway Research Program (Maggiore, Ford, CH 2M Hill, High Street Consulting Group & Burns & McDonell, 2015). In this case, the procedure is made up of the tasks below:

Form the above listings, it can be concluded that both procedures are quite similar, even though the PROCROSS method do not include a step for comparing the effects of funding levels.

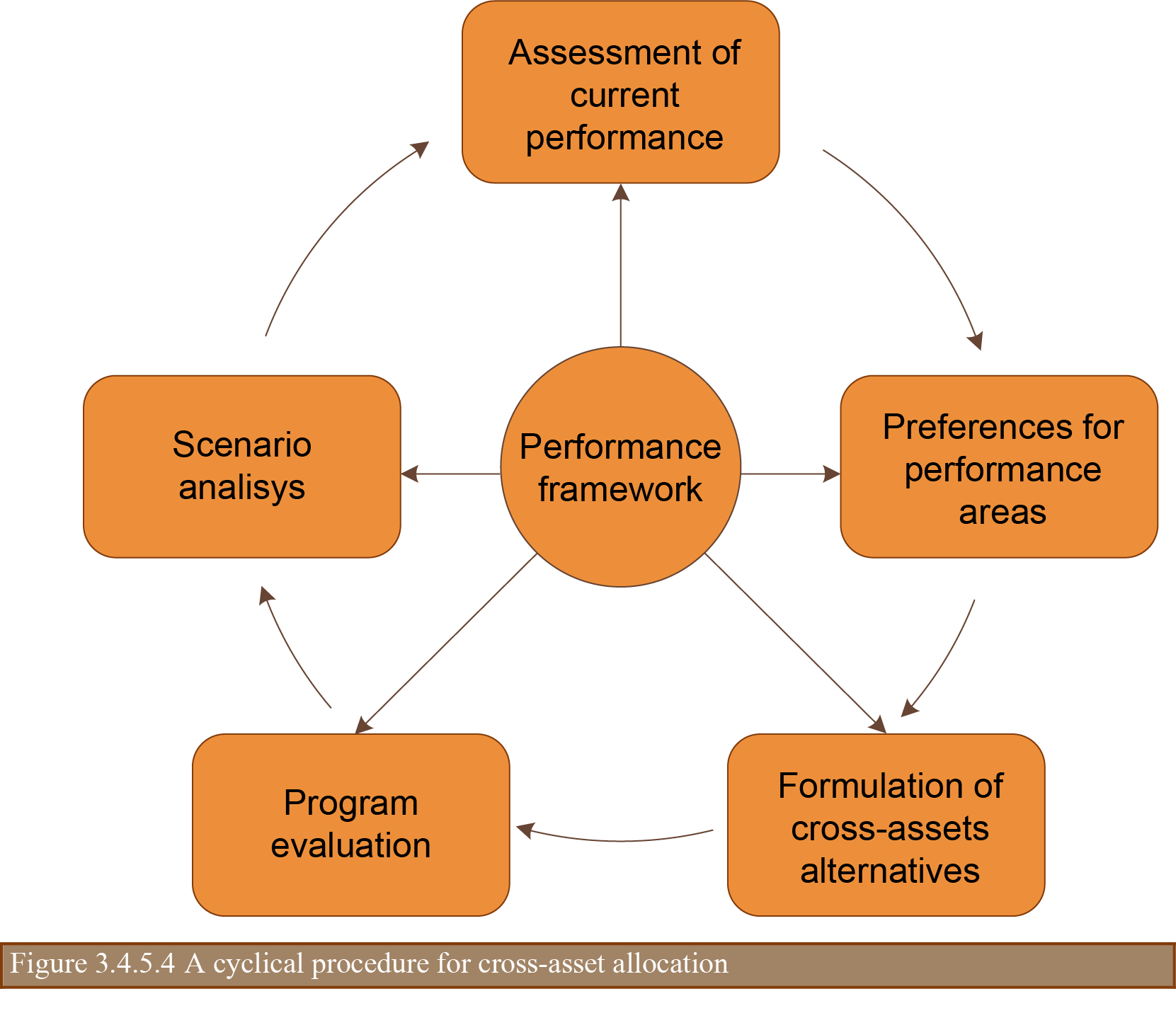

A further procedure for cross-asset allocation is presented next. Although, on the one hand, this procedure is based on the two methods outlined previously, on the other hand it assumes that the organization has developed a performance framework (see section 1.4) so the following items are already available:

Given the above, a cyclical procedure for cross-asset allocation can be depicted as shown in Figure 3.4.5.4.

The steps illustrated in this figure can be described as follows:

Assessment of current performance. It implies determining the organization progress in reaching the strategic targets defined within the performance framework. Any difference will represent a performance gap that has to be addressed through the proposed investment programs.

Development of individual programs. Works dealing with improving the condition of individual assets or any other attribute of the road network are identified in this step using specialized management systems for each asset / operational issue (pavements, bridges, safety, etc.) The resulting programs are intended to minimize the risk of not achieving the targets proposed for each performance area.

Formulation of cross-asset alternatives. Combines the projects selected for the individual programs in order to cover all performance areas with a single works program. Also, define alternative programs containing project options different from those selected in the previous step so that the preferences stated in the performance framework can be considered while carrying out cross-asset allocation under budget constraints.

Program evaluation. Refers to a decision-making process that should be applied to identify, using diverse criteria, the alternative of a cross-asset program that best contributes to attaining the targets specified in the performance framework. This involves comparing projects in terms of their benefits, which are normally expressed in different units depending on the performance area addressed by each project. Thus, all benefits should be normalized (i.e. converted to a common metric) to allow for comparison.

The international experience on cross-asset works programming comprise the application of decision-making techniques such as the following (Proctor & Zimmerman, 2016; Porras-Alvarado, Han, & Zhang, 2014):

The multi-criteria analysis may provide various advantages. First, the analyst priorities are specifically declared through the assignment of weights to the different performance areas. At the same time, the decision maker objectives are clarified while translating them into criteria for evaluating intervention alternatives. Furthermore, the system for evaluating alternatives is transparent since it leaves a clear record of the weights and criteria applied. Finally, the multi-criteria analysis is flexible as it permits criteria to be added as well as disparate criteria to be used.

However, it also has disadvantages: i) Costs and risks are not explicitly involved in the analysis; ii) Results are very sensitive to the values attributed to weights, so these can be determinant of the alternatives selected.

Cross-asset optimization involves the use of recursive mathematical procedures to find the maximum level of benefits that can be produced by a given set of investments subject to technical performance requirements and budget constraints. Its application implies the use of a software capable of evaluating a considerable number of options (hundreds or even thousands) to find the one yielding the greatest benefits. It this way, cross-asset optimization generates more sophisticated and quantified results, yet it requires extensive data about all candidate projects evaluated.

Scenario analysis. This last step is equivalent to the last step of the cross-asset allocation procedure proposed in the US NHCRP Report 806 (Maggiore, Ford, CH 2M Hill, High Street Consulting Group, & Burns & McDonell, 2015). As the latter, it consists of determining the effects of various investment scenarios and funding levels in the performance of the road network both as a whole and considering each individual asset / operational feature individually. The results of such an analysis can be used to identify the needs of stakeholders concerning the different performance areas and the budgeting required to meet those requirements, and eventually to modify appropriately the performance targets in use.

Finally, it should be noted that the procedure described above is based on the combined approach for cross-asset allocation portrayed in figure 3.4.5.3.3, as it starts with the individual analysis of each of the different performance areas, and then it combines candidate projects from the different programs to obtain a solution oriented towards achieving the performance goals of the road organization.

AM4INFRA 2019. Asset Management Approach for Transport Infrastructure Network (http://www.am4infra.eu/downloads/).

Austroads. 2009. Guide to Asset Management Part 4: Program Development and Implementation. Austroads Inc. Sydney, Australia.

—. 2002. "Integrated Asset Management Guidelines for Road Networks." Austroads Publications Online. Accessed April 9, 2015 (https://www.onlinepublications.austroads.com.au/items/AP-R202-02).