The purpose of asset valuation is the calculation of the financial value of an organization's assets reported at the end of a financial period. The valuation of road infrastructure assets is a business reporting requirement for many transportation organizations and an important component for the financial management of roads. Road assets support economic growth, but this is not considered as part of an asset's value and is measured separately through investment planning, as discussed in Chapter 3.2. Asset valuation is therefore primarily an accounting exercise, but it should also be used by engineers to support investment planning.

The principle purpose of asset valuation is to document the financial value of the road infrastructure assets owned by an organization and included on the organization’s financial balance sheet. Placing a monetary value on road assets emphasizes their importance and the potential cost to replace them and to return them to new condition. This cost is reported through the depreciation of the road asset, which represents the consumption of the asset in delivering services to road users and other stakeholders. It is essential that asset valuation for road infrastructure assets comply with the financial reporting requirements relevant to that particular country.

Monitoring how the asset value changes with time can indicate if the investment required to maintain the appropriate value of the asset is being provided. As such, monitoring can provide compelling arguments for investing in the preservation of the asset base to senior decision makers in the organization.

Experience in some countries, such as Finland, New Zealand, Australia, the U.S. (AASHTO 2013), and Canada (TAC 2015), has shown that implementing financial reporting of asset values for infrastructure assets has a significant impact on how maintenance and renewal work is funded. This reporting has generally resulted in an improvement in the maintenance of assets.

Asset valuation may be required to support the financial reporting requirements of an organization. It also provides the opportunity to describe the importance of the road asset and investment in that asset in financial terms. This will provide senior decision makers with appropriate information to understand the financial implications of their decisions. It will also provide the opportunity for presenting the case for the development of more cost-effective maintenance and replacement programs that will maintain the value of the transportation asset (PIARC 2008-a). The benefits of adopting this approach include the following:

Roads are mostly publicly owned and unlike property assets, will not have a value if sold on the open market unless the buyer is permitted to recover their investment through mechanisms such as tolling. These assets are therefore not generally used for the purpose of revenue generation. Hence, the method to be adopted for asset valuation should not be based on market value or revenue stream. Exceptions may include concessions, toll roads, and the refinancing of design, build, and operate contracts, where roads operate more as a utility.

In order to support the business requirements of the organization, the method of calculation for asset value must follow the accounting standards of that organization. International Accounting Standard 16 is one of the accounting standards that may be adopted. It is also common practice that these standards are interpreted through codes of practice and other guidance and standards in order to be used for asset valuation.

The approached used to calculate the value of an asset must be repeatable and consistent because it is collected according to accounting rules and is subjected to robust internal controls and a formal audit regime. Applying these principles to the production of data for road assets not only ensures that the data is fit for use for reporting the value of the asset, but also provides high-quality information to support the management of the assets and maximize the value delivered from both past investment and future expenditure.

Within accounting, depreciation is used to provide a measure of the cost of the economic benefits embodied in an asset that have been consumed during the accounting period. Depreciation can be measured in various ways. For commercial undertakings, a key aim should be to reflect changes in market value or income generating potential, but for long-life public sector infrastructure, a more appropriate measure is what needs to be spent to maintain the asset in a stable condition. The principles of calculating asset depreciation and asset deterioration are not always the same. This may lead to differences in future asset investment and future asset value.

An historical cost-based approach to valuing road infrastructure assets may be used as a starting point. However, this approach is not a good basis for dealing with assets that have very long lives. It provides some information about what is being spent on the assets, though even this is not necessarily consistent between organizations, but it says nothing about the effect the expenditure has on the condition of the assets or how much it matches spending needs. For those organizations starting asset management, this may be adopted as a basis for providing some simple financial information.

A more advanced approach is to adopt depreciated replacement cost (DRC), which is a method of valuation that provides the current cost of replacing an asset with its modern equivalent asset, minus deductions for all physical deterioration and impairment. Gross replacement cost (GRC) is based on the cost of constructing an equivalent new asset, and the difference between the gross and depreciated cost is the cost of restoring the asset from its present condition to “as new” condition. Annual depreciation is calculated by identifying all the capital treatments needed to maintain assets or key components over their lifecycles and then spreading the total cost evenly over the number of years in the lifecycle. Calculated in this way, annual depreciation not only represents the annual consumption of service benefits, but also provides a measure of what, on average, needs to be spent year to year to maintain the assets in a steady state.

The methodology used to calculate the asset value depends on the asset under consideration. International Accounting Standard 16 requires that where an asset can be broken down into identifiable components with different useful lives, those components should be accounted for separately. For practical purposes, this means breaking assets down into their key parts at a sensible level of materiality, not trying to separately identify and account for every individual element. Components need to be distinguished in terms of those that have a finite life, at the end of which they will be replaced, and those that, given appropriate capital maintenance (replacement of subcomponents), will last indefinitely.

Assets need to be grouped in a consistent manner so that data can be aggregated for regional or national purposes, for example to determine actual expenditure or estimated spending need for a particular asset class, to allow organizations to benchmark performance against other organizations, and to allow individual organizations to track performance over time.

Classifications that may be used are shown in Table 3.3.5. The list is not exhaustive.

The levels in the table are defined as follows:

Level 1: Asset types include broad categories based on the general function of the assets. They divide the asset base into categories that may be suitable for reporting in the financial statement and that provide an appropriate a basis for high-level management information;

Level 2: Asset groups are used to distinguish between assets that have a similar function and form; and

Level 3: Components distinguish between asset components that may require individual depreciation models, e.g., to calculate different service lives and/or rates of deterioration.

Once the assets are divided into appropriate components, it is necessary to determine the expected or remainng life of each component or rehabilitation treatment. The useful life of individual components also determine whether or not it is appropriate to group components.

Assets and components fall into one of two categories: (1) those with a finite life, at the end of which they will need to be replaced, typically 20–40 years, although some assets will have considerably shorter or longer lives, and (2) those that, given the necessary capital expenditure, will have an indefinite life. Indefinite life components can be further subdivided into those that require capital maintenance to allow them to achieve their expected life and those that do not.

For a finite life asset or component, the lifecycle period will be the whole of the anticipated life. For an indefinite life component, the period will be based on the life of any capital treatments (PIARC 2005) necessary to keep it in use. Judgement needs to be applied here. If, for example, over time an asset would receive a number of cheaper, shorter-lasting treatments plus a single major, long lasting treatment, then the lifecycle should be based on the latter to ensure that the activities and costs captured are fully representative over the longer term.

If, exceptionally, a component that had been categorized as not requiring any treatments to maintain its life indefinitely does experience deterioration (for example, due to inadequate maintenance of surface layers), then it will need to be re-categorized and an appropriate lifecycle plan developed.

It is essential that assumptions about the remaining life of an asset, component, or treatment are reviewed annually and revised when necessary.

Rates used for the calculation of GRC should be the rates used for new construction and should the organization’s own rates. They should reflect actual rates at the time; proposed improvements in procurement or other factors that might lower rates in future years should not be anticipated.

In some cases, organizations may not have sufficiently recent rates of their own. This is most likely to arise with certain infrequent maintenance or replacement activities, for example when maintaining or replacing structures. For anything else, organizations should take appropriate steps to obtain a realistic estimate, for example by seeking rates from similar or neighbouring organizations.

Replacement costs should be the net of any residual (disposal) value of the asset or component. In most cases, disposal will be part of the replacement works and will therefore already be reflected in the unit cost rates. For example, in a street lighting replacement contract, the contractor will normally be responsible for removing and disposing of the old assets as well as installing the replacements, and the rates will take account of any scrap value. However, when that is not the case, any residual value will need to be netted off from the replacement costs.

Condition or performance data needs to be collected with sufficient frequency and consistency to provide a representative view of the condition of the asset and to track how this changes over time. The data can then be used to support deterioration modelling.

In many cases, organizations may not know the age of an asset or component or how long ago a particular capital treatment was carried out. In these cases, it is necessary to use condition as a basis for estimating age, e.g. the asset is rated at 7 our of 10 and for assets that have been subjected to a similar rehabilitation treatment, it would be expected that with a condition rating of 7, the asset would be 5 years of age. Deterioration modelling is important in estimating and then monitoring the future performance of an asset or treatment, in particular when the asset will need to be replaced or treatments carried out (PIARC 2003, PIARC 2008-b).

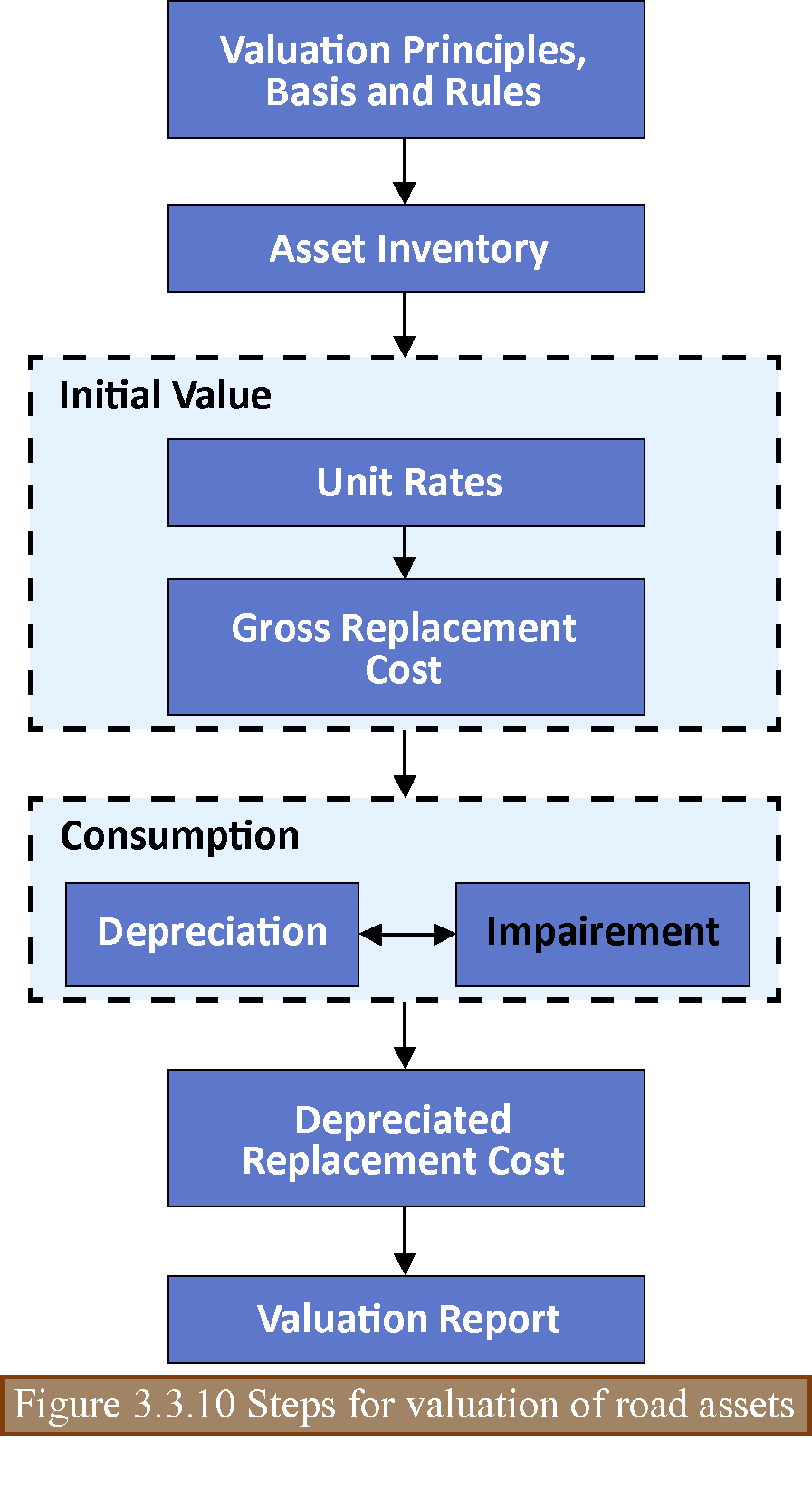

The general procedure for the valuation of road infrastructure assets consists of the following steps:

1. Establish the principles, basis, and rules for asset valuation. These should comply with the valuation requirements provided.

2. Compile an asset inventory that provides the base data for calculating asset values for all road infrastructure assets.

3.Calculate the initial value of the road infrastructure assets. This involves the following:

4. Calculate the consumption of the assets, which involves the following:

5. Calculate the depreciated replacement cost, which involves the following:

6. Prepare the valuation report.

Key aspects of these steps are shown in Figure 3.3.10 and defined below.

A summary of the key steps for the valuation of roadway assets are as follows:

Assets should be subject to full revaluation at least once every five years. In between revaluations, normally on an annual basis, the valuation report can be adjusted using appropriate price indices.

AASHTO 2013. Transportation Asset Management Guide – A focus on Implementation. American Association of State Highway and Transportation Officials, Washington, D.C.

CIPFA 2010. Code of Practice on Transport Infrastructure Assets. Chartered Institute of Public Finance and Accountancy.

PIARC 2003. Indicators for Bridge Performance and Prioritization of Bridge Actions, Committee on Bridges and Other Structures, ISBN 2-84060-161-3 (https://www.piarc.org/en/order-library/4504-en-Indicators%20for%20Bridge%20Performance%20and%20Prioritization%20of%20Bridge%20Actions.htm).

PIARC 2005. Evaluation and funding of road maintenance in PIARC member countries, Committee on Financing and Economic Evaluation, ISBN 2-84060-182-6 (https://www.piarc.org/en/order-library/4546-en-Evaluation%20and%20funding%20of%20road%20maintenance%20in%20PIARC%20member%20countries.htm).

PIARC 2008-a. Asset management practice, Committee on Management of Road Infrastructure Assets (4.1), ISBN 284060-211-3 (https://www.piarc.org/en/order-library/6014-en-Asset%20management%20practice.htm).

PIARC 2008-b. Indicators representative of the condition of geotechnical structures for road asset management, Committee on Earthworks, Drainage and Subgrade (4.5), ISBN: 2-84060-301-6 (https://www.piarc.org/en/order-library/5780-en-Indicators%20representative%20of%20the%20condition%20of%20geotechnical%20structures%20for%20road%20asset%20management.htm).

TAC 2015. Synthesis of Asset Management Best Practices for Canada. Transportation Association of Canada, Ottawa, Ontario

CARLOS RUIZ TREVIZAN, National Highways Laboratory Department, Highway office, Chile

An important component of Road Infrastructure Management is the Valorization of the Road Patrimony. It has been shown that the annual calculation of road assets enables government agencies to monitor infrastructure and minimize the loss of value of it associated with causes such as physical deterioration, underutilization or security risks. In addition to the above, the value of the Road Patrimony makes it easier for the agencies to make investment decisions as well as justifying the necessary amounts of investment in conservation of the Road infrastructure. In this way, the impact of the investments made by the State on its infrastructure that is under the direct tuition of the road agency can be determined, so that the works and conservation actions result in an increase or, at least, the maintenance of the Road Patrimony.

To calculate the Road Patrimony it is necessary to define a clear and concise methodology to achieve the objective, for which the National Directorate of Roads of Chile, due to modifications that have been made to determine the condition of the paved roads, considered necessary to update the current method of calculation, which is recommended by the Economic Commission for Latin America and the Caribbean (ECLAC) of the United Nations, for which during 2014 it hired a Consulting Company to carry out the Basic Study: "Methodology for the Determination of the Road Patrimony".

In this Basic Study the analysis, results and main conclusions were made regarding the determination of the Value of the Road Patrimony for the year 2013 according to a new methodology, where the calculation methods, the basic concepts, the databases and the program were updated computational for practical use. Depreciation methods were also determined in relation to climatic variables, traffic and in relation to their conservation, in addition new road assets were incorporated to consider all those under the administration of the National Directorate of Roads of Chile. For this calculation, the antecedents of the year 2013 of the paved national road network and the unpaved network were taken into account, considering also bridges, tunnels, bikeways and footbridges.

The PATVIAL 2.0 software, a computational application developed in this Basic Study, is used to calculate the Road Patrimony. This software automates the methodology used, regarding the entry and validation of data, determination of the value of the Road Patrimony, and analysis of results, according to the availability of information and the objectives of the project.

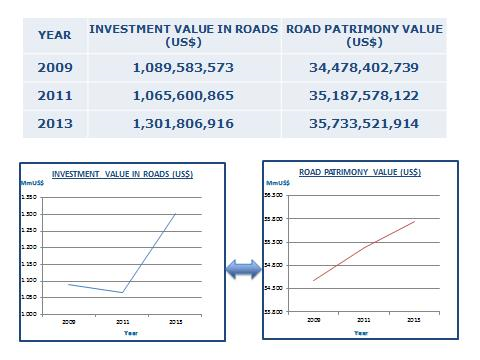

The calculation of the patrimony value of the paved and unpaved road network, excluding the road network under the concession system, in this Study was made for the years 2007, 2009 and 2011. In this way, information such can be obtained as the following Figure 3.3.12.1:

The correlation can be obtained between the levels of investment, disaggregated in conservation as such and investment in changes of standards with the variation of the patrimony value, is a powerful indicator of the degree that reaches the management of road infrastructure from the standpoint of efficiency and effectiveness in the use of public resources.

This area of road infrastructure management is currently being strengthened with various tasks aimed at systematizing the process of determining road assets, in particular 9 types of road assets have been defined, their design life, residual useful life and criteria for reevaluation. This process is part of the need assumed by the State of Chile with the Organization for Economic Cooperation and Development (OECD) in the sense of implementing the International Accounting Standards in the Public Sector through the instructions derived and led by the General Comptroller of the Republic, is why the NICSP-CGR as they are known by its acronyms, has generated a calendar of activities that should conclude the year 2021 with the determination of the patrimony value of the road infrastructure of the whole country under a system semi-automated calculation.

The design of the patrimony value system is completely inserted in the Road Asset Management system, so it will be fed from the databases that are updated based on the information from the visual inspections, the actions on the road infrastructure, whether they are conservation or improvement activities and the financial information to capture the capitalizable expenditures that will go directly to increase the patrimony value or the necessary expense for the administration of the accounting assets.

The implementation of this indicator will require adjusting different systems, already underway, but without a doubt the internal processes will be strengthened, giving value to many intermediate activities of the entire process of asset management.

More information can be found on the website of the National Directorate of Roads of Chile, in the area of the Road Management Department, according to the link: http://www.vialidad.cl/areasdevialidad/gestionvial/Paginas/Informesyestudios.aspx .